Brand Equity vs Brand Value Understanding the Difference

Brand Equity vs Brand Value: Understanding the Difference

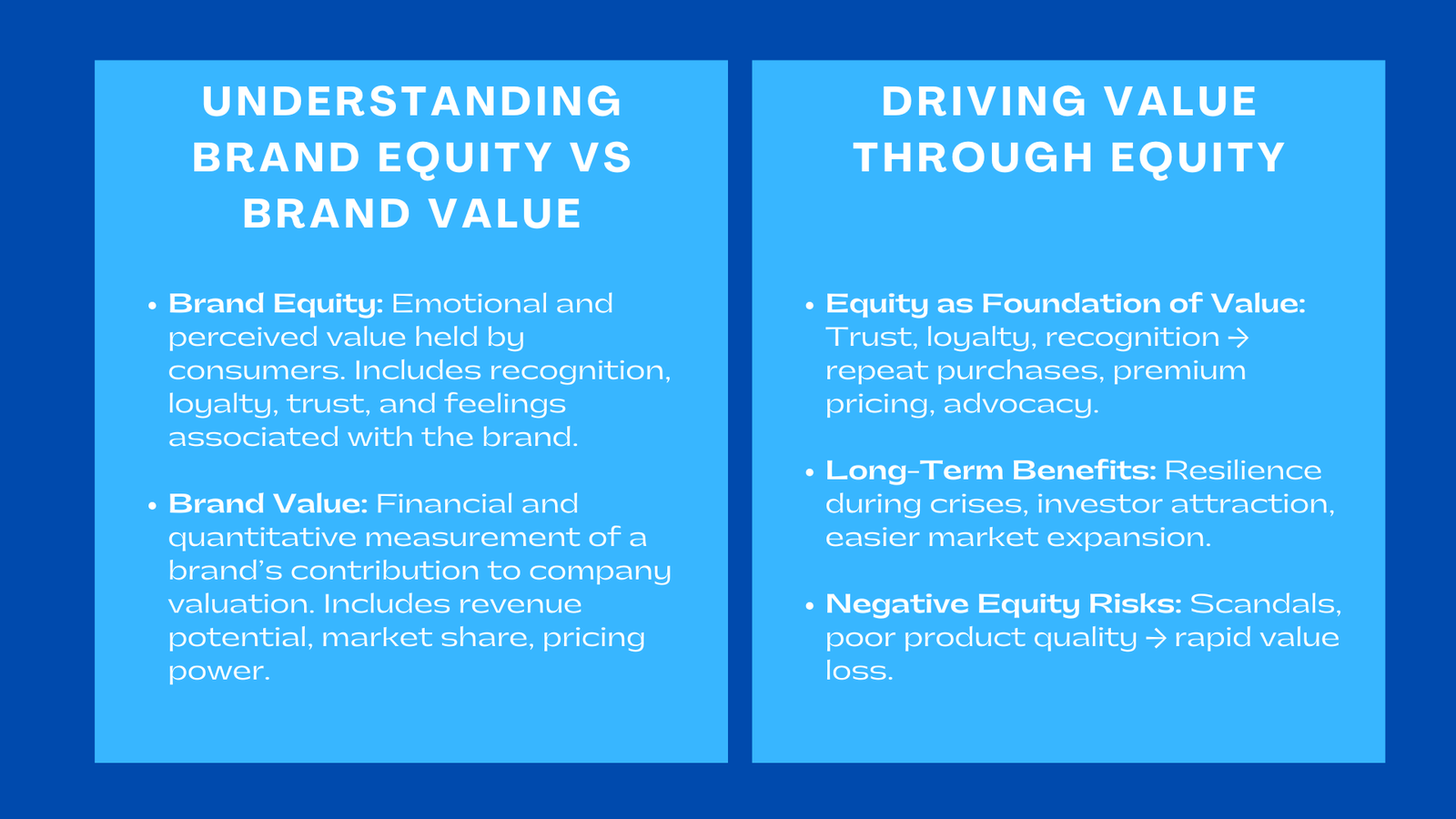

In today’s competitive business environment, brand equity and brand value are two of the most important assets a company can own. While these concepts are interconnected, they represent fundamentally different aspects of a brand. Understanding the nuances of each is crucial for organizations that aim to succeed both emotionally with customers and financially with investors.

Brand equity refers to the emotional, psychological, and perceived value a brand holds in the minds of consumers. It includes recognition, associations, loyalty, trust, and even the feelings that customers experience when they interact with a brand. For example, when a consumer thinks of Apple, they might associate it with innovation, premium quality, sleek design, and community belonging. These perceptions form the foundation of brand equity, which exists primarily in the minds and hearts of consumers rather than on a balance sheet.

Brand value, on the other hand, is quantitative and financial. It measures the brand’s contribution to the company’s overall valuation in monetary terms. Analysts and investors consider brand value when calculating a company’s worth, factoring in projected revenue streams, pricing power, market share advantages, and the long-term potential for growth. While brand equity reflects perception, brand value reflects impact—it converts the intangible perception into tangible financial results.

The distinction between these two concepts is critical. When brand equity drives financial brand value, Singapore diminishes due to inconsistent messaging, poor customer experiences, scandals, or negative publicity, brand value inevitably declines. This interdependence emphasizes the strategic importance of reputation management, customer trust, and consistent brand messaging. Companies that actively manage both brand equity and brand value are better positioned to achieve long-term growth, market resilience, and investor confidence.

How Brand Equity Drives Brand Value

Equity as the Foundation of Brand Value

Brand equity serves as the primary driver of brand value. Positive perceptions such as trust, loyalty, recognition, and emotional attachment influence consumer behavior and purchasing decisions. When customers feel connected to a brand, they are more likely to make repeat purchases, recommend the brand to others, and even pay a premium for products or services. Companies offering brand equity and valuation services in Singapore can help quantify these behaviors, which have measurable financial consequences such as predictable revenue streams, reduced marketing costs, and stronger pricing power.

Global brands demonstrate this relationship clearly. Apple has cultivated immense brand equity through innovation, sleek design, and creating a sense of community among users. This equity allows Apple to maintain high pricing without losing customers and to drive massive repeat purchases. Similarly, Starbucks leverages its equity through store experience, personalized service, and corporate social responsibility initiatives, which foster loyalty and advocacy that translate into measurable revenue.

In Singapore, brands like Charles & Keith have successfully built brand equity by closely monitoring customer preferences, curating fashionable and quality products, and maintaining consistent messaging across retail stores and online platforms. Singapore Airlines, renowned for service excellence and reliability, reinforces equity through customer experience, premium service, and consistent communication. These examples illustrate how brand equity creates tangible financial value, enabling companies to compete in highly dynamic markets.

The Long-Term Benefits of Strong Brand Equity

Brands with high equity enjoy several strategic advantages over time. First, equity provides resilience during crises. Companies with strong brand equity can maintain revenue and retain customer trust even during economic downturns or temporary negative publicity. Second, high-equity brands attract investors, partners, and stakeholders who see the brand as a reliable, sustainable asset.

Equity also enables market expansion. A brand with loyal customers and positive perception can enter new markets or launch new products more successfully, as customers are more likely to trust the brand and adopt new offerings. Singapore Airlines, for example, has maintained high customer loyalty and premium pricing despite global disruptions in aviation, emphasizing service excellence and brand reliability. Similarly, Charles & Keith leverages brand equity to expand into international markets while maintaining customer trust in product quality and style.

Over time, strong equity drives long-term brand value. Consistent positive perceptions increase market share, profitability, and enterprise valuation. Brand equity is the “emotional currency” that underpins financial performance, demonstrating that intangible consumer perceptions have measurable economic consequences.

The Fragility of Negative Brand Equity

While strong equity drives value, negative brand equity can quickly erode it. A single scandal, poor product quality, or inconsistent communication can destroy years of equity-building and significantly reduce brand value. For instance, Volkswagen’s Dieselgate scandal damaged its previously strong equity built on engineering excellence and environmental responsibility. The resulting financial penalties, legal challenges, and consumer distrust caused a measurable decline in brand value.

Similarly, brands in the fast fashion industry, such as H&M or Zara, have experienced reputational risks related to labor practices or environmental impact. Even temporary negative perceptions can impact sales and financial performance. These examples highlight the fragility of brand equity and the importance of proactive management. Companies must continuously monitor perception, address customer concerns, and maintain consistent quality and ethical standards to protect both equity and value.

Managing Equity and Value Together

Understanding Customer Sentiments

To maximize both brand equity and brand value, organizations must understand and respond to customer sentiments. This involves gathering feedback, monitoring social media and reviews, analyzing purchasing behavior, and identifying unmet needs or emerging preferences. By aligning products, services, and communications with customer expectations, brands strengthen loyalty and emotional engagement.

In Singapore, Charles & Keith tracks customer trends to adapt product design and marketing campaigns. Singapore Airlines continuously gathers passenger feedback to improve in-flight services, check-in procedures, and loyalty programs. By proactively responding to consumer insights, companies prevent equity erosion and ensure sustainable financial growth. Understanding customer sentiment is not just a marketing tool; it is a critical component of strategic brand management.

Translating Emotional Equity into Measurable Financial Value

Emotional engagement alone is not sufficient; it must translate into tangible financial outcomes. Organizations use valuation techniques, financial modeling, and market performance analysis to quantify the impact of brand equity on revenue, profitability, and enterprise valuation. Loyal customers represent recurring revenue, while strong brand recognition supports premium pricing and reduces acquisition costs.

For example, Apple’s ecosystem ensures customers remain loyal across devices and services, resulting in predictable recurring revenue and strong margins. Starbucks’ personalized experiences, loyalty programs, and consistent quality similarly generate measurable revenue. Integrating emotional insights with financial strategies ensures that brand equity drives not only consumer satisfaction but also business performance.

Consistency Across Touchpoints and Operations

Maintaining equity and value requires consistency across all touchpoints and operations. Every interaction—marketing campaigns, customer service, product quality, online presence, and corporate communications—affects perception and financial outcomes. A single negative experience can undermine years of equity-building, while consistent, high-quality interactions reinforce trust, loyalty, and recognition.

Global and Singaporean brands exemplify this principle. Apple, Starbucks, and Singapore Airlines maintain rigorous operational standards and cohesive messaging, ensuring equity translates into measurable financial value. Aligning all departments and touchpoints creates a virtuous cycle: positive experiences reinforce equity, which drives revenue and long-term growth.

Leveraging Brand Equity for Strategic Decision-Making

Strong brand equity also provides strategic insights for business decisions. Brands can use equity metrics to guide marketing budgets, product development, partnerships, pricing strategies, and market expansion. High-equity brands can confidently enter new segments or launch innovative products, leveraging existing customer trust to reduce perceived risk. Conversely, monitoring equity helps identify vulnerabilities and enables proactive measures to protect reputation and value.

Importance of Understanding Both Brand Equity and Brand Value

For contemporary organizations, understanding and managing both brand equity and brand value is crucial for long-term sustainability. Companies that fail to integrate the emotional and financial aspects of their brand risk weakening their market position, losing customer trust, and ultimately reducing revenue and enterprise valuation. Recognizing that brand equity drives consumer perception while brand value reflects tangible financial outcomes allows organizations to develop strategies that reinforce both simultaneously.

Structured Training Programs for Teams

Structured training programs are essential for educating teams on the core principles of balancing emotional engagement with financial performance. Employees must understand how initiatives designed to enhance customer experiences also contribute to measurable business outcomes, bridging the gap between marketing, customer relations, and finance. Part of the training involves teaching staff how to measure brand equity and translate it into financial models. This requires a combination of data analysis, financial forecasting, and valuation techniques to quantify the impact of customer loyalty, recognition, and trust on revenue and enterprise value.

Monitoring customer sentiment is another critical element. Teams are trained to gather and analyze feedback from surveys, social media platforms, and direct customer interactions. By identifying emerging trends, unmet needs, and potential pain points, employees can adapt products, services, and messaging to align with consumer expectations, thereby strengthening brand equity while supporting long-term financial growth. Additionally, training emphasizes the importance of operational consistency across all touchpoints. Maintaining quality in marketing, customer service, product delivery, and corporate communications reinforces trust and loyalty, ensuring that equity and value grow hand in hand.

Using Real-World Case Studies

Effective training also incorporates real-world case studies to illustrate the practical application of these principles. Global brands like Apple and Starbucks provide clear examples of how strong emotional engagement drives loyalty, advocacy, and ultimately revenue growth. Singapore-based companies such as Charles & Keith and Singapore Airlines demonstrate how local brands leverage equity to maintain customer satisfaction, expand into new markets, and achieve sustainable financial performance. Through these examples, employees gain insights into how consumer perception, operational execution, and financial outcomes are interconnected.

Ensuring Consistent Application Across Functions

The ultimate goal of training is to ensure that strategies are consistently applied across all organizational functions. Marketing campaigns, product development, and customer experience initiatives must align to reinforce both equity and value. When teams understand the connection between emotional resonance and financial performance, they are better equipped to make decisions that support long-term brand sustainability. Structured training fosters a culture of accountability, strategic thinking, and cross-functional collaboration, enabling organizations to maintain strong equity, maximize brand value, and achieve lasting competitive advantage.

Conclusion to Brand Equity vs Brand Value Understanding the Difference

Brand equity and brand value are interdependent pillars of business success. Brand equity reflects customer perception, loyalty, and emotional engagement, while brand value quantifies the tangible strategies to maximize brand equity and brand value Singapore contribution of the brand to financial performance. Equity drives value, and value sustains equity, creating a continuous feedback loop that reinforces both emotional and financial outcomes.

Organizations that master both dimensions create durable, profitable brands capable of thriving in competitive and dynamic markets. Structured training programs and proactive management of equity and value ensure that strategies are applied consistently across all touchpoints, supporting sustainable growth and long-term enterprise value.

Ultimately, a deep understanding of brand equity and brand value provides a foundation for lasting competitive advantage. Companies that integrate emotional, operational, and financial strategies cultivate loyal customers, sustain profitability, and achieve enduring growth. By prioritizing both perception and measurable impact, brands become strategic assets that drive long-term success, resilience, and market leadership.