Aligning Brand Valuation with Business Strategy

Aligning Brand Valuation with Business Strategy

Introduction to Aligning Brand Valuation with Business Strategy

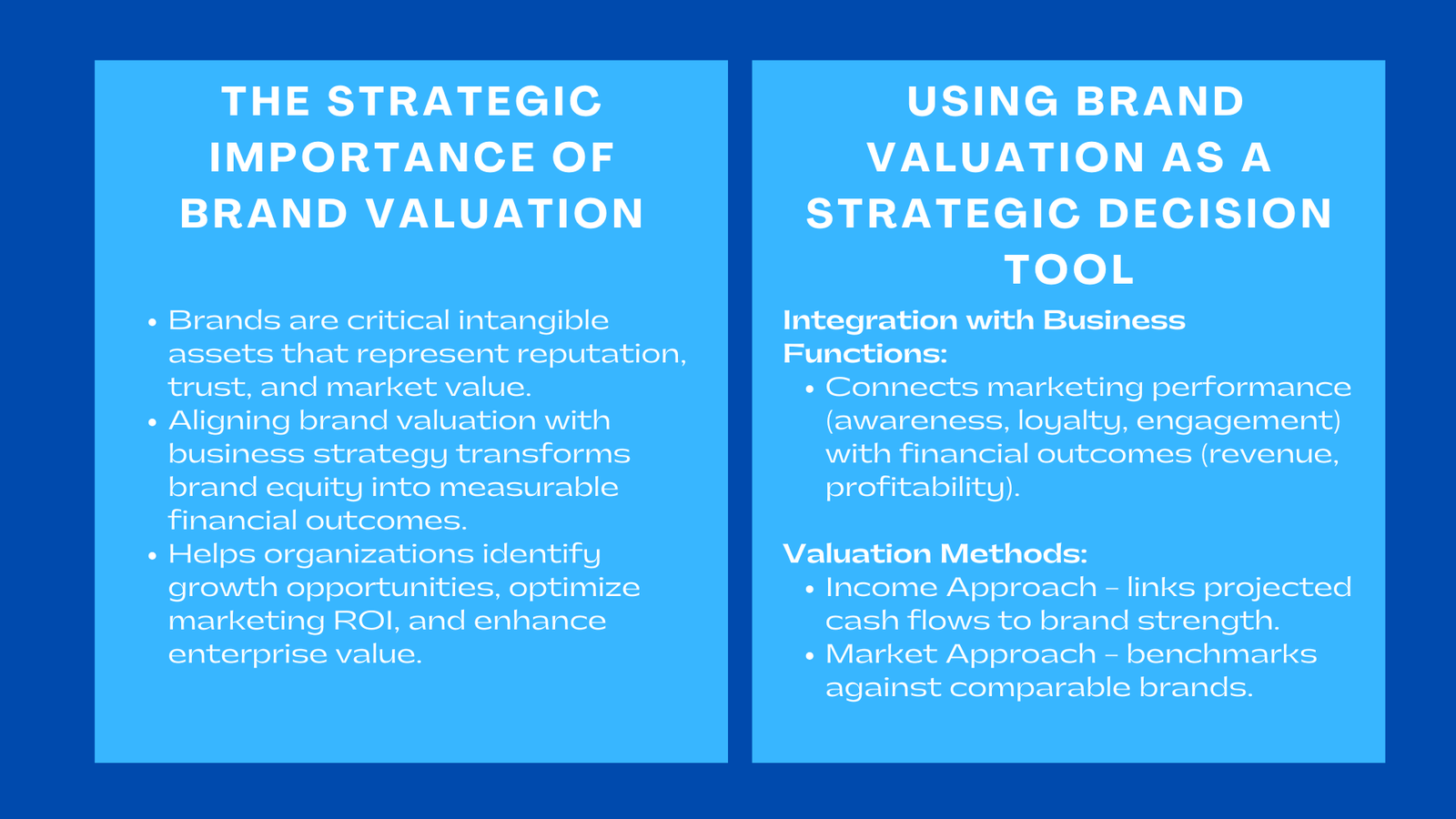

In today’s competitive business environment, brands are increasingly recognized as one of the most valuable intangible assets for companies. A brand is much more than a logo, tagline, or product design—it embodies a company’s reputation, customer trust, loyalty, market positioning, and future revenue potential. For startups and SMEs, brands often form the foundation of long-term growth and are critical in attracting investors, partners, and customers.

Aligning brand valuation with corporate strategy ensures that a company’s intangible assets are quantified not only for financial reporting purposes but also for strategic decision-making. Accurate brand valuation helps organizations identify opportunities for growth, optimize marketing and operational investments, and enhance enterprise value. When effectively integrated into strategic planning, brand valuation becomes a tool to transform abstract concepts such as loyalty and reputation into measurable financial outcomes.

In markets like Singapore, where startups, SMEs, and multinational corporations compete in a highly dynamic environment, strategic brand valuation planning is essential. Companies that adopt a systematic approach to valuing their brands can make informed decisions regarding resource allocation, market expansion, partnerships, and risk management.

Integrating Brand Valuation with Corporate Objectives

Aligning Marketing and Finance

Brand valuation serves as a bridge between marketing and finance functions. While marketing teams focus on customer engagement, brand perception, and campaigns, finance teams track revenue, cash flow, and profitability. By integrating these perspectives, organizations can evaluate the financial impact of marketing initiatives and ensure that brand investments deliver measurable returns.

For example, a consumer goods company may launch a national campaign to increase brand awareness. Brand valuation can quantify how the campaign contributes to incremental revenue, market share growth, or pricing premiums. This alignment ensures that marketing resources are allocated strategically, maximizing ROI while avoiding unnecessary expenditures.

Supporting Executive Decision-Making

C-suite executives rely on accurate brand valuation to make high-impact strategic decisions. These include decisions on market entry, product diversification, premium pricing strategies, partnerships, and mergers and acquisitions (M&A). A well-documented brand valuation framework equips executives with data-driven insights, helping them balance risk, forecast outcomes, and justify strategic initiatives to stakeholders.

For instance, when evaluating a potential acquisition, a startup may analyze the target company’s brand value to assess goodwill, potential synergies, and post-merger integration strategies. Without reliable brand valuation data, such decisions could be misinformed, increasing operational and financial risk.

Valuation Methodologies and Strategic Planning

Income Approach: Revenue-Based Valuation

The Income Approach focuses on the present value of projected cash flows generated by a brand. This methodology considers the brand’s influence on revenue, customer retention, and pricing power. It requires careful assumptions, such as anticipated growth rates, customer lifetime value, and competitive positioning.

For example, a software-as-a-service (SaaS) startup may project future subscription revenue based on user acquisition trends, churn rates, and pricing strategy. By discounting these cash flows using a risk-adjusted rate, management can estimate the brand’s financial contribution to enterprise value. This approach is particularly effective for established brands with predictable revenue streams.

Market Approach: Benchmarking Competitors

The Market Approach estimates brand value by analyzing comparable transactions, such as mergers, acquisitions, or licensing deals involving similar brands. This external benchmark provides validation for internally derived valuations and ensures credibility with investors, auditors, and regulators.

A regional food and beverage SME, for instance, may compare its brand with similar brands sold or licensed in the same geographic market. Adjustments are made for brand size, market positioning, and growth potential, resulting in a fair value estimate that reflects market realities.

Cost Approach: Investment in Brand Creation

The Cost Approach considers the total investment required to develop or replicate a brand. This includes marketing campaigns, digital presence, advertising, promotional materials, and brand development initiatives. For early-stage startups or SMEs with limited revenue history, this approach offers a practical method to estimate brand value based on tangible inputs rather than revenue projections.

A fashion startup, for instance, may calculate the cumulative costs of social media campaigns, influencer collaborations, and e-commerce platform development to derive the minimum economic value of its brand. This method highlights the resource intensity of brand creation and helps management plan future marketing investments strategically.

Key Brand Metrics and Indicators

Brand Awareness and Recognition

Brand awareness is a fundamental measure of how familiar your target audience is with your brand. It not only includes the ability of consumers to recognize or recall the brand but also how strongly it stands out compared to competitors. This can be assessed through surveys, social media reach, search volume trends, or mentions in media. High brand awareness indicates effective marketing, a strong presence in the market, and establishes trust before purchase decisions even occur. For instance, in Singapore’s competitive FMCG market, brands that invest in omnichannel campaigns—combining online and offline touchpoints—often achieve higher brand recognition, which directly translates to consumer preference and sales growth. Many companies also integrate brand valuation services Singapore for business strategy to ensure that their brand awareness efforts are aligned with measurable financial performance and long-term enterprise value.

Customer Loyalty and Advocacy

Customer loyalty is a critical driver of sustained revenue, as acquiring new customers is often more costly than retaining existing ones. Tools like Net Promoter Score (NPS) measure the likelihood of customers recommending your brand to others, providing insights into advocacy potential. Loyal customers not only make repeat purchases but also become brand ambassadors, amplifying marketing efforts organically. Tracking retention rates, frequency of engagement, and repeat purchase patterns allows companies to tailor loyalty programs effectively. For example, subscription-based startups in Singapore use tiered loyalty programs to reward long-term subscribers, boosting lifetime value and reinforcing emotional connection to the brand.

Customer Lifetime Value (CLV)

Customer Lifetime Value estimates the total revenue a brand can expect from an individual customer over the duration of their relationship. CLV connects customer engagement, retention, and spending behavior to financial outcomes, offering a strategic perspective on resource allocation. By identifying high-value customer segments, businesses can prioritize marketing, product development, and service initiatives that maximize profitability. For instance, a tech SaaS startup might analyze CLV across subscription tiers to determine which features or services drive the most revenue and adjust their product roadmap accordingly. CLV also helps quantify the long-term impact of brand investments, linking intangible brand equity to measurable financial performance.

Digital Engagement Metrics

In the modern digital landscape, measuring engagement across platforms is crucial to understanding brand health. Metrics such as social media followers, content shares, likes, comments, click-through rates, website traffic, app downloads, and in-app interactions provide detailed insights into audience behavior. Monitoring trends over time allows companies to optimize marketing strategies, create targeted content, and enhance user experience. In Singapore, e-commerce and lifestyle brands increasingly rely on AI-powered analytics to track engagement patterns, segment users, and deliver personalized campaigns. High engagement not only strengthens brand visibility but also drives conversions and loyalty, ultimately impacting revenue streams.

Financial Impact Metrics

Quantifying the financial outcomes of brand activities ensures that brand management aligns with corporate strategy. Metrics such as incremental revenue attributable to brand initiatives, price premiums enabled by strong brand perception, and market share growth link brand performance to enterprise value. For example, luxury fashion brands in Asia can charge premium prices due to strong brand equity, and tracking this impact helps justify marketing spend and strategic initiatives. By combining these financial indicators with engagement and loyalty data, companies can develop a holistic view of how their brand contributes to overall business success and competitive positioning.

Reputation and Sentiment Analysis

Brand reputation and market sentiment are increasingly critical in an era of social media scrutiny. Analyzing customer reviews, social media conversations, media coverage, and public sentiment provides qualitative insights into brand perception. Tools for sentiment analysis can identify patterns of positive, neutral, or negative feedback, helping brands anticipate issues and respond proactively. For example, a Singapore-based food and beverage brand may track online reviews to detect emerging service issues, adjust operational strategies, and maintain consumer trust. Reputation management not only safeguards brand equity but also enhances investor confidence, as stakeholders often consider public perception when evaluating corporate value.

Benchmarking Against Competitors

To contextualize brand performance, companies must measure their metrics relative to competitors. Benchmarking helps identify gaps, strengths, and opportunities for differentiation. Metrics such as social media engagement rates, NPS comparison, website traffic share, and market penetration relative to competitors allow organizations to adjust strategies and capture market share. In highly competitive markets like Singapore, benchmarking provides actionable insights for startups and SMEs looking to grow efficiently while maintaining a strong brand presence.

Integration of Metrics into Strategic Decision-Making

Collecting metrics alone is not sufficient; brands must integrate them into actionable strategies. Combining awareness, loyalty, engagement, financial impact, and sentiment metrics allows leadership teams to make informed decisions about product launches, marketing campaigns, market entry, or brand repositioning. For example, if social media engagement indicates high interest in sustainability messaging, a company can align product development and marketing to emphasize eco-friendly practices, thereby strengthening brand equity and market appeal. This integration ensures that brand metrics drive tangible business outcomes rather than remaining abstract numbers.

Brand Valuation as a Decision-Making Tool

Resource Allocation and Investment Planning

Quantifying brand value allows organizations to prioritize investments in high-impact areas. Marketing initiatives, product innovation, and customer experience improvements can be justified using valuation data, ensuring that resources are deployed effectively to maximize ROI. By linking financial outcomes to brand strategy, management can focus on initiatives that enhance enterprise value.

Mergers, Acquisitions, and Partnerships

Brand valuation is critical in negotiations for M&A transactions, licensing agreements, or strategic partnerships. Companies with documented brand valuations can negotiate better terms, ensure asset prices align with market expectations, and mitigate risk for stakeholders. This not only safeguards enterprise value but also reinforces strategic positioning during high-stakes business transactions.

Integrating Risk Assessment into Brand Valuation

Brands face a multitude of risks including market shifts, competition, regulatory changes, and reputational issues. Scenario planning and sensitivity analysis allow organizations to model different outcomes, anticipate potential challenges, and adjust strategies proactively. By integrating risk assessment into brand valuation, companies can maintain resilience and protect both financial and reputational assets.

Conclusion: Long-Term Benefits of Strategic Brand Valuation

Strategic brand valuation in corporate strategy planning transforms brands into actionable, measurable assets that provide tangible insights for decision-making. When brand valuation is aligned with corporate objectives, monitored through key performance indicators, and informed by risk assessment, it becomes a powerful tool to guide investment, marketing, and growth strategies. Companies that integrate brand valuation into strategic planning position themselves for sustainable growth, enhanced market presence, and long-term competitive advantage.

Beyond financial measurement, a well-executed brand valuation framework strengthens organizational coherence, aligns internal stakeholders around shared objectives, and enhances credibility with investors, partners, and customers. For startups and SMEs, these benefits are particularly critical, as early-stage businesses must demonstrate value, manage resources efficiently, and navigate competitive markets. Over time, continuous refinement of brand valuation practices ensures that intangible assets are leveraged to their full potential, maximizing enterprise value while supporting innovation, market relevance, and resilience in a rapidly changing business environment. By embedding brand valuation into the core of strategic planning, organizations create a sustainable advantage that extends far beyond immediate financial outcomes, establishing a foundation for long-term growth and corporate success.