Certified Brand Valuation Training and Audit

Common Brand Valuation Mistakes and How to Avoid Them

Introduction: Certified Brand Valuation Training and Audit

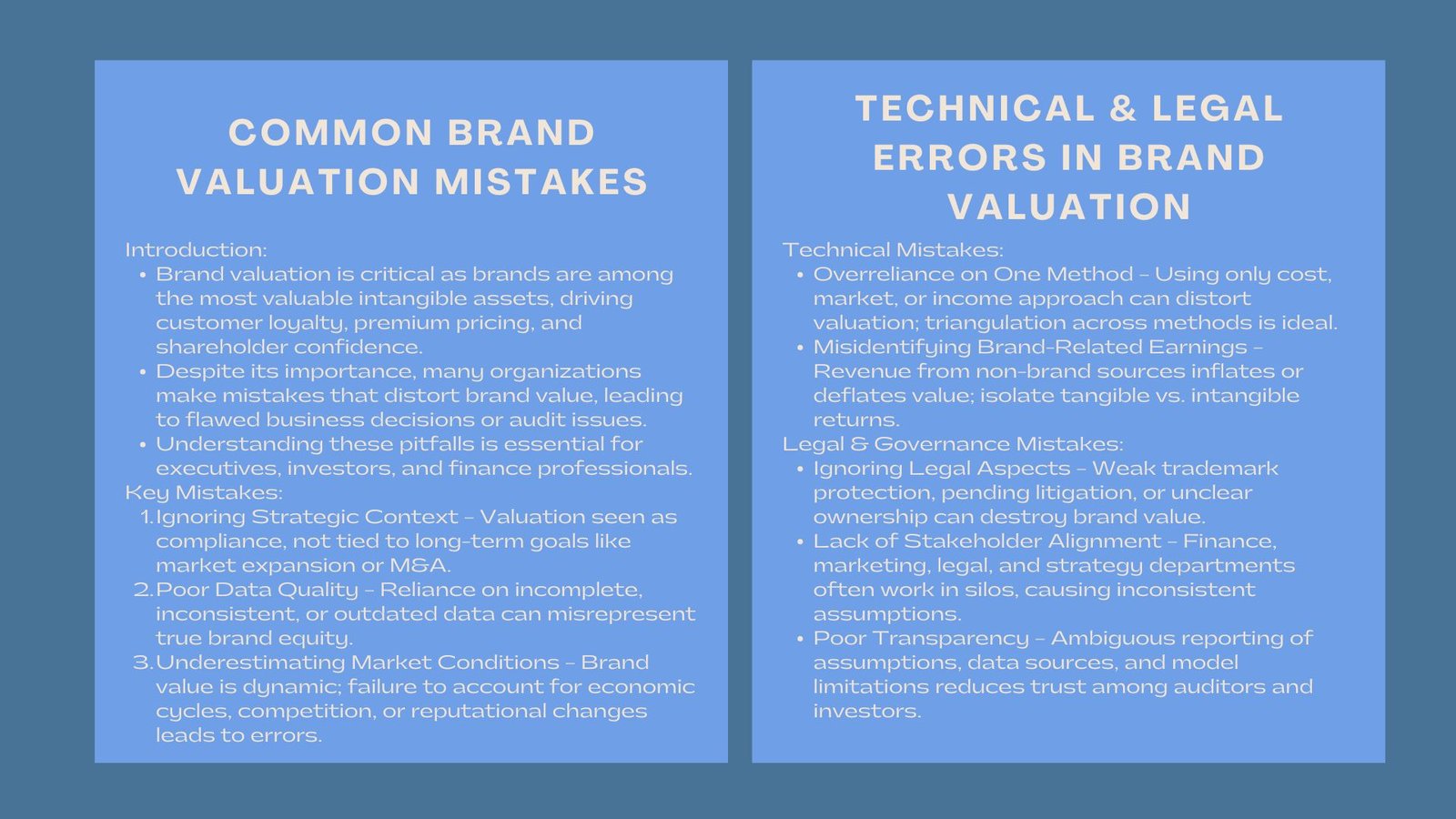

With the current competitive market, the brands form some of the most beneficial intangible resources of an organization. A well-built brand will help in customer loyalty, premium pricing, as well as increase shareholder confidence. However the true value of it is still a difficult and misjudged task. Brand valuation demands technical accuracy as well as good sense in the application of financial and strategic principles. Much to their chagrin, numerous businesses end up committing preventable mistakes that provide perverted outcomes, flawed business judgments, or contentious audit and dealings.

Knowledge about these pitfalls is essential to corporate executives, investors, and finance personalities who base their decision-making process on brand valuation. Here, we discuss the commonest pitfalls of brand valuation practice- and how to eliminate them in a rigorous, transparent and evidence-based manner.

Learning to be Wary of Low Brand Valuation.

Ignoring the Strategic Context.

Among the sins, one of the most widespread is that brand valuation is a detached exercise that is not tied to corporate strategy. Valuation is a management tool but most organizations have perceived that valuation is a requirement. The valuation can be not strategic without the insight into how the brand performance should be correlated with long-term goals, i.e. expanding the market, preparing towards M&A, or communicating with investors.

The substantive brand value ought to explain the role of brand strength in financial performance and competition. This involves the incorporation of valuation results as part of the wider business decision making like capital allocation, pricing and market positioning. When valuation is applied only to financial reporting or regulation purposes, companies do not have a chance to employ it as a strategy growth measure.

Disregard for the Significance of Data Quality.

Accurate information on valuation is very important. There can be severe errors caused by the lack of incomplete or obsolete financial data, inconsistency in brand metrics, and subjective assumptions. One example is that measuring brand equity using marketing spend only excludes both behavioral and legal aspects that bring value.

Firms are advised to invest in having steady, verifiable data sources, that is quantitative performance and qualitative attributes of the brand. Such a method is important that the valuation findings are based on real economic potential and not estimation bias. Adhering to best practices such as the brand valuation process and methodology Singapore standard ensures objectivity and comparability across time and markets.

Underestimating the Position of Market Conditions.

The value of a brand, however, does not remain constant, it changes in relation to the mood of the market, the cycle of the economy and the competitiveness. The brand strength can be misrepresented by neglecting to modify assumptions in response to changing industry dynamics. As an example, a brand that has been successful in an ideal situation might lose its equity in market declines or reputational disasters.

Scenario and sensitivity analyses should be involved in valuation models. These enable the decision-makers to assess the influence of such variables as discount rates, market share changes, and revenue predictions on brand value in varied conditions. It also aids in continuous monitoring of the organizations to find out the early warning signs of brand erosion before it starts affecting the financial performance.

Technical Errors in Methodology of Valuation.

Depending on a Unique Valuation Technology.

Failure to cross-check the results of the two methods of valuation: a cost method and a market method is another error that is frequent. All approaches have their own knowledge: the income approach reflects potential earnings in the future, the market approach is the one which compares the brand with similar ones and the cost approach corresponds to the value of investment in the brand.

Triangulation of valuation ought to be based on numerous methods of valuation to create reasonableness and reliability. This combined approach is a better-rounded outlook on brand value, both objective and subjective. High dependency on one measure is prone to distortion especially when the market data or forecast is volatile.

Reporting Misidentified Brand-Related Earnings.

The accuracy of the valuation requires the isolation of brand-driven income to be right. Companies usually inflate or deflate this aspect so as to encompass revenue sources that are not brand-related like distribution benefits, contracts and special promotions.

The appropriate brand earnings attribution involves the separation of the returns of the tangible assets (e.g. technology or real estate) and intangible brand returns. More sophisticated models will typically use the differential analysis to determine the impact of brand strength on consumer preference and pricing power. This makes sure the contribution of value of the brand is not over rated or not rated at all.

Ignoring Legal and Ownership Problems.

One of the most common but minor errors is to leave the legal aspect of brand ownership aside. Brand value can be destroyed in a very short time by weak trademark protection, pending litigation, or unfinished licensing documentation. In case of the ownership ambiguity, some of the brand projected revenues may not be completely defendable.

In the process of valuation, analysts will need to examine trademark registration, domain registration, and any third party licensing. It is important to make the rights of the brand legally enforceable to ensure that the company has the capacity to monetize and control its brand rights in a way that is effective.

Communication and Governance Problems.

Absence of Stakeholder Alignment.

Some of the departments that are involved in brand valuation are finance, marketing, legal and strategy. Lack of alignment will result in the assumptions being inconsistent and disagreements on methodology. As an illustration, the marketing units can concentrate on the awareness and perception measurements, whereas the finance departments will place more emphasis on the discounted cash flow analysis.

Good governance involves setting up of good valuation policies and cross-functional working. The stakeholders are expected to reach a consensus as to the use of valuation such as financial reporting, transaction support or strategic planning and establish uniform parameters of each use.

Lack of proper Transparency in Reporting.

Most of the valuation reports are not transparent enough in terms of assumptions, data source, and model limitations. Such ambiguity may destroy trust in auditors, investors, or even regulators. A clear report must have a clear explanation of how earnings of the brand were calculated, the discount rates used and the selection of benchmarks of similar type.

Transparency is particularly necessary when the results of valuations are applied in capital markets, or in the course of due diligence. Working with experienced valuation professionals, such as firms specializing in independent brand valuation for financial reporting Singapore, ensures compliance with international audit standards and stakeholder expectations.

Taking Valuation as a One-Time Event.

Brand value is a constantly changing phenomenon, which reflects the trends of the market, the mood of the consumer and the actions of the competitor. Firms that engage in valuations periodically at the time of transactions or regulatory exercise risk missing out on gradual change in the performance of the brand.

Periodic reappraisals give us information on the effects of marketing efforts, a novelty, or customer experience on the brand equity in the long term. Organizations may quantify if their brand strategies are producing actual economic payoff by monitoring variations in these on either a yearly or biannual basis.

Best Practices of Trustworthy Brand Valuation.

Methodological rigidity, sound data, and external validation form the basis of a reasonable valuation. Taking into account the comprehension of the financial, behavioral, and legal points of view, the organizations are expected to embrace standardized frameworks like ISO 10668 and ISO 20671. These standards allow consistency in the global marketplace as well as the fact that output of the valuation is more defensible in case of audit or negotiations.

In addition, engaging both the internal and external specialists will improve objectivity. External advisors offer objective evaluation and benchmark information whereas internal stakeholders offer operational context. Such a participative style comes in between technical accuracy and strategic applicability that brings results that the management can rely on and take action.

Brand valuation is not merely about how one puts numbers on the brand, but rather about knowing what the numbers are motivated by. Through valuation embedded in strategy development, firms are able to improve their positioning in the market, capital deployment and improve the overall enterprise value.

Conclusion

Brand valuation mistakes may be expensive–as much as buying a business too much or reporting assets incorrectly. These errors should be avoided through a rigorous process, credible information and constant monitoring. Properly executed, brand valuation is an effective decision-making tool–companies can protect their image, maximize returns on investment and establish long-term shareholder trust.

Instead of measuring brand value, organizations with a combination of financial discipline and strategic acumen will discover that the concept of brand value involves mastering one of the most powerful motivating factors in corporate success.