Certified Brand Value Growth Framework

Mastering the Brand Value Chain Model for Strategic Growth and Market Performance

Introduction to Certified Brand Value Growth Framework

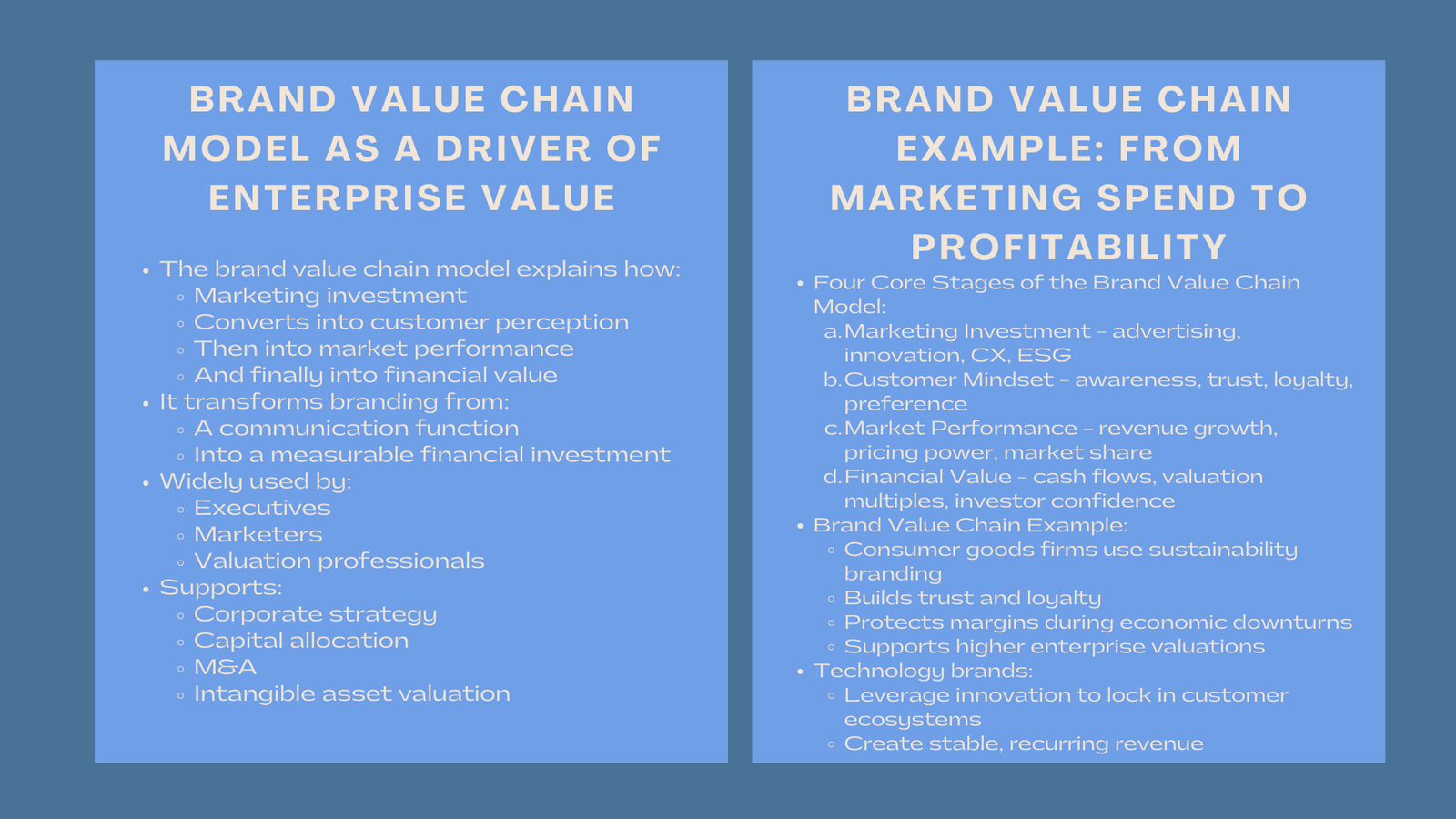

Living in the age of corporate valuation where intangible assets take center stage, the question of how marketing investments could be converted into financial performance is no longer a choice. The brand value chain model offers an organized model that describes how activities of building the brand translate into customer behavior, market influence and ultimately shareholder value.

The art of brand value chain model is compulsory among executives, marketers, and valuation professionals in their quest to ensure that the gap that exists between the brand strategy and quantifiable financial results is bridged. The brand value chain example through application to the real world explains how firms can systematically convert brand efforts into enterprise value and the brand value chain diagram provides a visual roadmap of the transformation. This model is central to the strategic brand governance as global markets are becoming more competitive and data-driven.

1. Conceptual Foundations of the Brand Value Chain Model

1.1 Strategic Purpose of the Brand Value Chain Model

The brand value chain model has been created to explain how the marketing activities create values at various organizational levels. As compared to the traditional branding theories, which emphasize on a single branding method, such as awareness or perception, the brand value chain model incorporates all marketing inputs, change of mindset by customers, market performance results and financial value creation in a continuous logic system. Its strategic significance is in the fact that it is able to create quantifiable financial performance by transforming the intangible brand equity.

This model appreciates the fact that branding is not a communication activity but it is an investment of the enterprise that directly relates to profitability, risk reduction and long term market capitalization. Subsequently, the brand value chain model has been a critical model in corporate planning, financial modeling, as well as valuation advisory practices.

1.2 Evolution of the Brand Value Chain in Corporate Strategy

In the past two decades, globalization and digitalization have increased the speed of brand visibility, customer engagement and reputational risk. As a reaction, the brand value chain model has been transformed into an instrument of marketing to a cross-functional strategic tool employed by finance and investor relations, ESG and risk management experts. This has placed brand governance with capital allocation, merger and acquisitions, and enterprise risk management.

2. Structural Architecture of the Brand Value Chain Model

2.1 Marketing Investment as the Value Input

Marketing investment is the initial stage of the brand value chain model. Such investments are the advertising spending, the digital engage sites, product development, customer experience programmes, channel alliance and corporate social responsibility activities. All the financial commitments that are undertaken at this point are value catalysts and not cost centers when handled strategically.

In the real-life consulting engagement, a connection between capital expenditure and brand performance is now modelled directly, which makes brand value chain model very attractive to CFO and boards interested in accountability in brand expenditure.

2.2 Customer Mindset as the Psychological Conversion Layer

The second layer of the brand value chain model is the transformation of marketing investment into customer mindset. This is brand knowledge, perceived quality, emotional attachment, trust, and loyalty. The brand does not just work based on awareness but is a high-performing brand based on Psychological preference that is sustained.

An example of the brand value chain that is most commonly quoted is in the premium consumer electronics where constant innovation and customer experience converts the perception into long term loyalty. It is this psychological conversion that insures price premiums and bullies demand in economic slumps.

3. Market Performance and Financial Value Creation

3.1 Market Performance Metrics

The market performance is transformed to the customer mindset by the third layer of the brand value chain model. These are revenue growth, customers acquisition efficiency, reduction in price elasticity, market share growth, and channel dominance. These are market performances which are the initial stage wherein financial metrics would be a direct result of brand investment.

Practically, valuation professionals place much weight on this layer in their future cash flow forecasts that can be attributed to the strength of brand. The greater the conversion efficiency of this layer, the greater the sustainable competitive advantage.

3.2 Financial Market Impact

The last section of the brand value chain model is a translation of the market performance into the financial value. This involves the performance of stock, valuation multiples of the enterprise, merger premiums and investor confidence. Brands exhibiting consistent conversion using the previous layers have a higher valuation resistance even in the face of macroeconomic instability.

A robust brand value chain example is seen in the international consumer goods organizations that retain high valuation multiples when the cyclical downturns occur, owing to overall steady brand-based demand.

4. Practical Interpretation Through a Brand Value Chain Example

4.1 Global Consumer Goods Industry Illustration

A practical brand value chain example can be observed within multinational consumer goods corporations. Significant marketing expenditures on sustainability communication, package redesign and online consumer interaction drive directly into customer confidence and luxury positioning. This further enables the company to maintain margins even in the face of increased input costs.

The brand value chain model is the reason why such companies are able to justify such aggressive marketing budgets to investors. Market leadership will be a translation of customer loyalty, and ultimately result in high enterprise valuation.

4.2 Technology Sector Brand Value Creation

Another powerful brand value chain example emerges in the technology sector. On-going investment in innovation builds stronger perception of usability and lock-in of the ecosystem, which boosts switching costs and lifetime customer value. It is the model of the brand value chain that shows how this system of psychological attachments creates recurrence of stability of revenue and high valuation multiples.

5. Strategic Role of the Brand Value Chain Diagram

5.1 Communication and Governance Tool

The brand value chain diagram is a visual governance tool that is used in boardrooms, strategy workshops, and valuation committees. The brand value chain diagram enables the marketing leader and the financial governance to align with each other by mapping the way the marketing inputs are translated between the operational and financial layers.

The aesthetic nature of the brand value chain diagram also allows the cross-functional stakeholders to decode intricate brand-financial connections devoid of technical questions. It converts the brand strategy dialogue into the formal enterprise value dialogue.

5.2 Analytical and Valuation Applications

The brand value chain diagram is becoming a standard feature of the transaction advisory, impairment testing, and brand portfolio valuation of valuation professionals. The diagram helps the analysts to assign cash flows of the forecasts directly to the brand-based elements as opposed to the overall performance of enterprises.

6. Brand Value Chain Model in Corporate Valuation

6.1 Integration with Business Valuation

The brand value chain model is an attribution engine in valuation engaging. It links brand actions to revenue elasticity, acquisition efficiency of customers and terminal value assumptions. The brand value chain model is able to augment the credibility of discounted cash flow models when it is appropriately applied by isolating the economic benefits that are caused by brands.

In intellectual property-intensive deals, such as licensing, franchising and technology, valuators rely on the model of brand value chain to justify high valuation differentials.

6.2 Role in Mergers and Acquisitions

In cross-border acquisitions, the brand value chain model serves the purpose of analyzing brand synergy. The model is applied by acquirers to determine the effects of marketing size, geographic diversification, and portfolio diversification in enhancing brand-based financial performance.

One widely cited brand value chain example in M&A involves luxury goods acquisitions, where brand perception, not physical assets, constitutes the majority of purchase price allocation.

7. Digital Transformation and Brand Value Chain Acceleration

7.1 Data Analytics and Brand Performance

The brand value chain model can now be observed in real-time on the digital platforms. The customer sentiment analysis, social engagement analytics, loyalty data and predictive demand modeling allow firms to quantify each aspect of the brand value chain model with more precision than ever before.

This technological transformation makes the brand value chain model even more powerful as it becomes a must have in any contemporary brand management in the unstable digital markets.

7.2 Artificial Intelligence in Brand Value Creation

These AI-based analytics can now be used to improve the predictive portion of the brand value chain model by predicting customer dislocation, price elasticity, and competitive risks. These forecasts are directly applied in the valuation forecasting and capital allocation.

8. Risk Management and Brand Value Protection

8.1 Reputational Risk and Value Leakage

The brand value chain model can also be used as a risk diagnostic model. Any failure in the chain of transmission of the value can lead to a quick crash of an enterprise caused by failures in communication alignment, the quality of products, or scandals in the sphere of government.

A crisis event provides a reverse brand value chain example, the reputational loss of trust instantly destroys customer trust, collapses in a performance in the market, and market capitalization losses are acutely experienced.

8.2 Regulatory and ESG Pressures

The environmental, social and governance scrutiny is now permeating into the brand value chain model. The lack of sustainability disrupted the value generation at the stage of customer mindset and undermined the financial viability and brand equity in the long term.

9. Strategic Branding and Long-Term Enterprise Growth

9.1 Brand Investment as Capital Allocation Strategy

The brand spending is considered to be a strategic capital expenditure instead of discretionary cost when corporations consider the brand value chain model as an institution. Return on brand investment is now being viewed with the same seriousness as factory expansion or acquisition of technology by investment committees.

The brand value chain diagram is often used in presentations to investment committees to support the investment cycles of a multi-year brand investment.

9.2 Competitive Advantage Through Brand Governance

Companies which regulate branding using the brand value chain model end up getting better long term defensive positioning. Their brands are strategic economic resources as opposed to operating strategies. This structural regulation makes branding a lasting enterprise value generator and not a cyclical marketing process.

10. Industry-Wide Application of the Brand Value Chain Model

The brand value chain model is used in the financial service, healthcare, consumer product, education, aviation, and technology industry. The mechanics of conversion vary in every sector, but the underlying reasoning is similar. An example of a high-impact brand value chain in the healthcare sector demonstrates how the trust of the patients would be translated into referral dominance and lifelong revenue streams.

Brand value chain model usually dictates the strength of exit valuation across the spectrum of private equity. Acquisition premiums always have a high impact on portfolio companies whose resiliency of cash flow has been documented to be based on brand.

Conclusion

The brand value chain model is the most detailed model on the market currently that can be used to define the relationship between brand-building actions and financial performance that can be measured. The model allows the executives to regulate the branding as a fundamental enterprise resource and not a discretionary cost through a systematic combination of marketing investment, customer psychology, market performance, and financial valuation.

The example of practical interpretation of a brand value chain shows how actual companies maintain high valuation by transforming trust, loyalty, and perception into sustainable streams of revenues. With the visual accuracy of the brand value chain diagram, organizations can now have the capacity to entwine marketing, finance, and strategy into a system of intertwined value generation. Since intangible assets have occupied the lead in the balance sheets of corporate bodies, brand value chain model mastery will be among the most decisive skills in the contemporary leadership of enterprises.