Brand Valuation Risk Management Strategies

Brand Valuation Risk Management Strategies

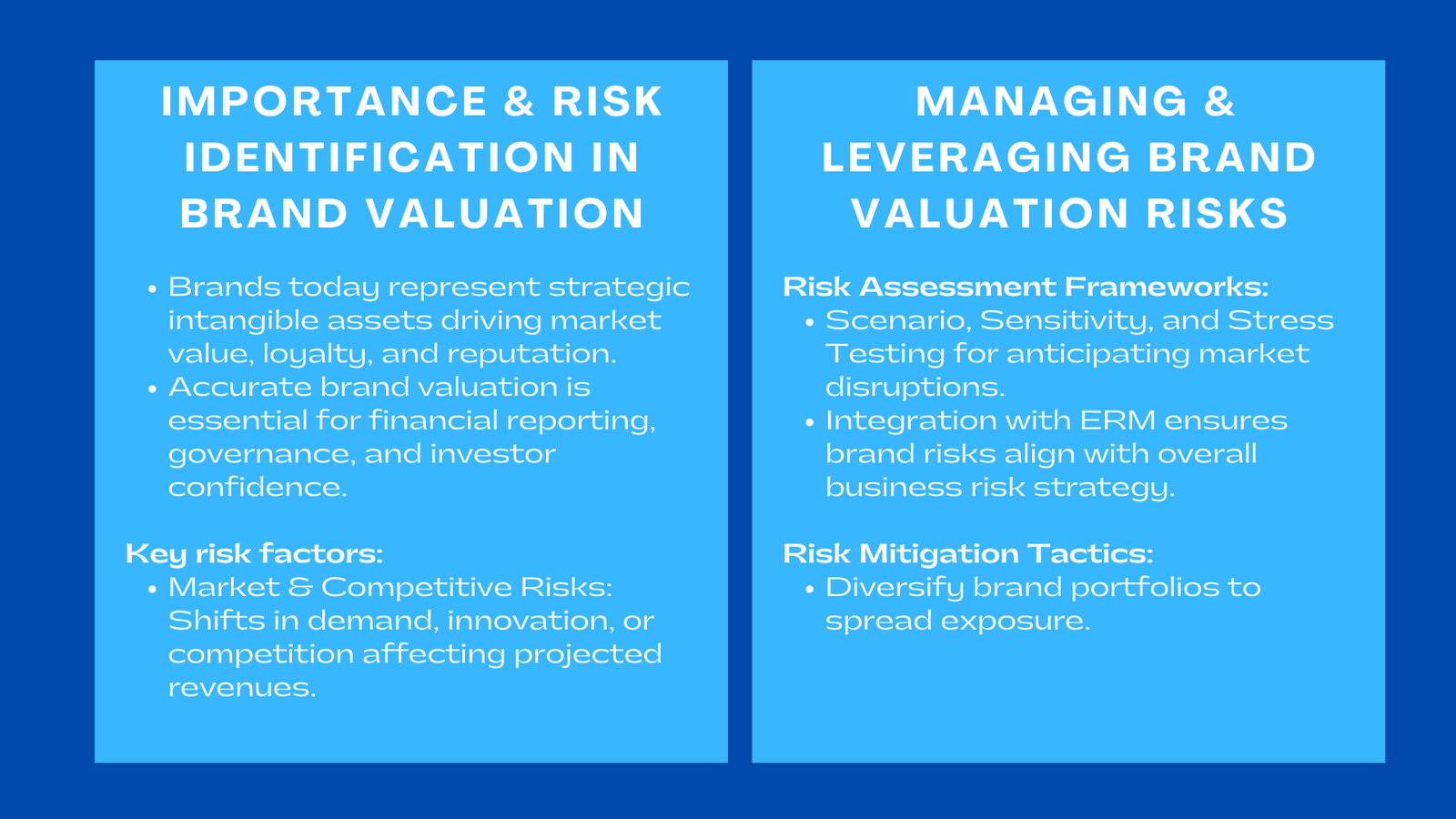

Brands today are far more than visual identities, logos, or slogans—they represent strategic intangible assets that capture consumer perception, loyalty, innovation, and corporate reputation. A strong brand significantly contributes to a company’s market value, competitive positioning, and long-term growth potential. For many modern companies, brand equity can account for a substantial portion of total enterprise value, particularly in industries such as consumer goods, technology, luxury, and services.

Because brands are critical to both financial and operational outcomes, brand valuation has become a fundamental component of corporate governance, investor relations, and strategic decision-making. However, accurately assessing brand value is complex. It involves forecasting future revenue streams, evaluating market dynamics, assessing consumer behavior, and analyzing operational capabilities. All these variables carry inherent risks.

Market volatility, technological disruption, regulatory changes, shifts in consumer preferences, and internal operational uncertainties can lead to significant deviations between projected and actual brand performance. Inaccurate brand valuation can result in misguided investment decisions, financial misreporting, and reputational damage, undermining stakeholder confidence.

Effective brand valuation risk assessment addresses these challenges. It enables companies to systematically identify potential threats, quantify their impact, and implement proactive mitigation measures. Beyond protecting the financial value of the brand, risk-aware practices provide a strategic advantage by enabling better decision-making, optimizing resource allocation, and ensuring regulatory compliance. In fast-evolving markets such as Singapore, where consumer expectations are high and competition is fierce, structured risk management is indispensable to sustaining brand equity and driving long-term growth.

Identifying Risks in Brand Valuation

Market and Competitive Risks

Market and competitive dynamics are among the most critical factors affecting brand valuation. Sudden changes in consumer preferences, emerging competitors, or economic shifts can reduce anticipated revenue streams or diminish brand equity. For example, a smartphone brand may see a decline in projected revenues if a competitor releases a device with superior specifications or an innovative user experience. Understanding how to value your brand in Singapore for fundraising and investment becomes essential in such cases, as accurate valuation helps businesses navigate market shifts, attract investors, and maintain brand strength amid competition.

To mitigate market and competitive risks, organizations must conduct continuous market research, competitor benchmarking, and consumer trend analysis. This helps anticipate shifts in demand, identify emerging competitors, and assess the potential impact on brand equity. Companies can also leverage scenario planning to model how market fluctuations or competitive pressures could influence brand value. By integrating market insights into valuation models, organizations ensure assumptions are realistic, defensible, and aligned with real-world conditions.

Operational and Internal Risks

Internal operational factors can also significantly affect brand valuation. Fragmented processes, insufficient collaboration between departments, inconsistent data collection, or inaccurate reporting can lead to misrepresentation of brand performance. For instance, if marketing data on customer engagement is not aligned with finance metrics, projected cash flows and valuation estimates may be skewed.

Organizations should implement standardized reporting procedures, robust internal controls, and cross-functional collaboration frameworks to manage operational risks. Integrating risk management into internal workflows ensures that data is accurate, reliable, and auditable. Operational risk oversight also facilitates more accurate brand valuation, strengthens governance, and provides greater confidence to investors and stakeholders.

Regulatory and Compliance Risks

Changes in accounting standards, intellectual property regulations, or disclosure requirements can influence brand valuation methodologies. For example, updates to IFRS guidelines or local reporting requirements can alter how intangible assets are recognized and measured, potentially impacting balance sheets and reported enterprise value.

To address these risks, organizations must maintain ongoing awareness of regulatory developments, adopt transparent reporting practices, and document all assumptions and valuation methods. Engaging external experts or auditors ensures compliance with applicable standards. Proactively managing regulatory risks enhances credibility with stakeholders, reduces the likelihood of legal or financial penalties, and demonstrates a commitment to governance excellence.

Reputational Risks

Reputation is central to brand value, yet highly susceptible to external shocks. Negative publicity, product recalls, social media controversies, or ethical lapses can rapidly erode brand equity. While the immediate financial impact may not always be visible in accounting records, long-term enterprise value can decline significantly if reputational damage persists.

Proactive reputation management is therefore a critical component of brand risk management. Strategies include monitoring social and traditional media, implementing crisis response protocols, investing in corporate social responsibility initiatives, and engaging in proactive stakeholder communication. By incorporating reputational risks into valuation models, companies can ensure that projected brand value reflects both tangible and intangible risks accurately.

Risk Assessment Frameworks for Brand Valuation

Structured frameworks help organizations systematically identify, quantify, and prioritize risks affecting brand valuation.

Scenario Analysis: Organizations model potential outcomes under adverse conditions such as economic downturns, competitor disruptions, or regulatory changes. Scenario analysis enables firms to prepare mitigation strategies and anticipate the potential impact on brand equity.

Sensitivity Testing: Sensitivity testing examines how variations in key assumptions—such as discount rates, projected revenue, or market share—affect brand valuation outcomes. This approach highlights which assumptions are most critical, helping decision-makers focus resources on areas that could most impact brand value.

Stress Testing: Stress testing simulates extreme, low-probability events, such as global crises, natural disasters, or abrupt regulatory changes, to evaluate vulnerabilities. By stress testing valuation models, companies can proactively develop contingency plans, maintain liquidity, and ensure brand resilience under adverse conditions.

Integration with Enterprise Risk Management (ERM): Incorporating brand valuation into the broader ERM framework ensures that brand-related risks are not evaluated in isolation but considered alongside operational, financial, and strategic risks. This integration fosters a comprehensive approach to risk management and strengthens overall corporate governance.

Risk Mitigation Strategies for Brand Assets

Diversification of Brand Portfolio

A diversified brand portfolio spreads risk across multiple products, markets, or customer segments. Multinational companies often manage several complementary brands to ensure resilience against market and competitive shocks. For instance, consumer goods firms maintain brands targeting different demographic groups or price segments, reducing dependency on a single revenue stream and preserving overall enterprise value.

Robust Data Governance and Analytics

Reliable, auditable data underpins accurate brand valuation. Organizations should implement integrated analytics platforms, standardized data collection protocols, and cross-functional reporting structures. Monitoring brand performance metrics, customer engagement, and marketing ROI provides evidence-based insights for valuation assumptions. Additionally, leveraging advanced analytics, artificial intelligence, and predictive modeling can help identify emerging risks and forecast potential impacts on brand equity.

Insurance and Legal Protections

Brands face exposure to IP infringement, litigation, regulatory violations, or contractual disputes. Employing intellectual property insurance, enforcing contractual safeguards, and ensuring compliance with legal and regulatory frameworks helps minimize financial losses. These measures stabilize brand valuation and provide stakeholders with confidence that brand assets are protected.

Continuous Monitoring and Revaluation

Brand value is dynamic, influenced by evolving market conditions, consumer sentiment, competitive activity, and operational performance. Continuous monitoring enables companies to detect emerging risks early, update assumptions, and implement mitigation strategies promptly. Regular revaluation ensures that brand assets remain accurately represented on the balance sheet and supports data-driven strategic decision-making.

Strategic Benefits of Brand Risk Management

A robust brand risk management framework provides multiple strategic benefits. Companies can optimize marketing expenditures, make informed investment decisions, and improve operational efficiency by proactively managing brand-related risks. Risk-aware organizations are also better prepared for M&A transactions, licensing negotiations, and strategic partnerships.

Embedding risk management into brand valuation strengthens corporate governance, enhances investor confidence, and ensures alignment between brand strategy and overall business objectives. Furthermore, it allows companies to anticipate market disruptions, manage operational inefficiencies, and sustain enterprise value in volatile environments.

Organizations adopting this approach also gain competitive advantage by demonstrating foresight and resilience. Investors, customers, and partners are more likely to engage with companies that actively manage brand risks and transparently communicate brand value assessments.

Case Study: Singapore FMCG Brand

A Singapore-based FMCG company adopted a structured brand risk management program prior to regional expansion. Scenario analysis modeled the impact of economic volatility, regulatory changes, and competitive actions. Sensitivity testing evaluated variations in discount rates and revenue projections, while stress testing simulated extreme market events such as supply chain disruptions and sudden shifts in consumer demand.

Integrated data governance ensured consistent tracking of marketing metrics, customer loyalty, and digital engagement. IP insurance and contractual safeguards protected the brand against infringement risks. Continuous monitoring allowed real-time adjustments to marketing strategies, promotional campaigns, and valuation assumptions.

As a result, the company maintained brand equity, preserved enterprise value, and enhanced investor confidence throughout its regional growth. This case demonstrates how embedding risk management into brand valuation enables organizations to navigate complex, dynamic markets while protecting critical intangible assets.

Conclusion to Brand Valuation Risk Management Strategies

Brand valuation without a comprehensive risk management framework is incomplete. Systematic identification of potential risks, robust mitigation strategies, and continuous monitoring ensure that brand assets retain their economic and strategic value. Risk-aware brand valuation enhances transparency, provides defensible data for investors, and supports informed decision-making across the organization.

Companies that integrate risk mitigation brand assets practices gain resilience in volatile markets, optimize investments, and protect enterprise value. They can anticipate market shifts, mitigate operational inefficiencies, and maintain compliance with IFRS and local reporting standards. Proactively safeguarding intangible assets not only preserves financial value but also reinforces reputation, strengthens competitive positioning, and drives long-term growth.

In highly competitive environments like Singapore, risk-conscious brand management is a key driver of sustainable enterprise performance. It ensures that the intangible power of a brand translates into measurable business outcomes, offering strategic agility, operational resilience, and market credibility. Organizations that embed risk management into brand valuation transform brands from potentially vulnerable assets into powerful, value-generating pillars of corporate success.

Ultimately, effective brand risk management creates a virtuous cycle: stronger valuations enhance investor confidence, support strategic expansion, attract top talent, and reinforce brand reputation. Over time, this approach ensures that the full potential of brand assets is realized, allowing companies to leverage their intangible power as a strategic growth engine and a key differentiator in competitive markets.