Excellent Brand Valuation for Finance and Marketing: Bridging Two Worlds

Excellent Brand Valuation for Finance and Marketing: Bridging Two Worlds

Introduction: The Convergence of Finance and Marketing in Brand Value

Over the past decades, finance and marketing were regarded as two isolated fields whose intersection was negligible to some extent. Business units selling products and services prioritized numeric outcomes (revenue, profitability, and shareholder value), whereas marketing teams were interested in conceptual outcomes (brand image, brand loyalty and emotional appeal). Nonetheless, the growing awareness of brands as intangible assets has changed the perception of businesses relating to the relationship. Looking at where brand valuation came in, it is at the crossroads of the two worlds, bringing financial rigor together with marketing knowledge, to create a balanced picture of the role brand plays in long-term business success.

Bridging marketing and finance in brand valuation is a very critical issue. Financial stakeholders are interested in the defendable numbers to evaluate brand-driven growth and marketers in the demonstration of the definite returns of their brand-building activities. By comprehending to what extent the two viewpoints can contribute to the valuation practices, companies will be able to fully exploit the potential of their brands and position them as strategic agents instead of simple objects of communication.

Finance Perspective: Brands as Assets in Valuation and Reporting

In financial terms, brands are becoming more and more able to be evaluated, purchased, sold, or licensed. When two companies merge, acquire each other or become partners, then it becomes necessary to be able to value a brand in order to negotiate and calculate. In reality, regulatory standards like International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) mandate that the acquired intangible assets valuation Singapore including brands are to be measured and placed in the balance sheets.

Measuring a brand from a finance perspective has its methodology on cash flow and returns on investment. Discounted Cash Flow (DCF) models, relief-from-royalty determinations, and the results of comparable transactions, all come up with quantifiable results that an investor or regulator can trust. The most critical question to financial executives is not only on the cost of the present-day value of the brand but also on how this brand could provide future economic advantages.

By doing so, finance makes the concept of brand valuation Singapore more than a perception and puts it in the realm of measurable financial effects. The result assists in strategic advanced finance assets in valuation and reporting involving investment allocating, portfolio optimization and risk analysis.

Marketing Perspective: The Intangible Power of Brand Equity

Whereas finance is all about the numbers, marketing lends voice to the less quantifiable yet equally decisive journey to brand value. A good brand results in customer loyalty, enables high prices, and builds up emotional attachments that endure over a long period of time. However, these factors might not reflect in the financial books at once, yet their effects on the long-term worth of revenue flows cannot be exaggerated.

Marketing based?brand valuation seeks to derive consumer oriented measures as brand awareness, perceived quality, customer satisfaction, and brand associations. Market research, focus groups and surveys will give information how the consumers perceive the brand and how they interact with it. The insights play a vital role in helping explain why a brand has higher market share or price premiums than other brands, even though their products may technically be similar.

The marketing view shows brand strength as a protective device as well. A strong brand in unstable markets will enable the companies to maintain consumers and endure shocks. Marketing provides the qualitative data that is translated into quantifiable results that finance can apply to assign quantitative form to brand equity.

Integrating Financial and Marketing Approaches to Valuation

The inability to separate bridging finance and marketing is further placed in a united approach to create methodology to both countable cash flows and the unquantifiable factors creating consumer behavior. Hybrid valuation models will seek to find an equilibrium in these two different schools of thoughts by considering the financial metrics and the consumer insights. As an illustration, an income-based valuation may estimate future revenues that can be attributed to the brand, and at the same time make corrections based on brand strength indicators that are obtained through market studies.

The method provides a more logical expression of brand value. Although it is outward financial results that constitute the evidence of impact, consumer perception tends to be the harbinger of future success. Financial models fail to reflect the true value of a brand growing without the consideration of marketing aspects. On the other hand, unless the financial discipline exists, marketing intelligence may lack gravitas that may be desired by the shareholders or regulating authorities.

The cross-functional teams are more and more the means through which brand valuation activities are carried out by successful organizations. Both the finance and marketing professionals work together and agree to common goals, models and paradigms. Such a cross-disciplinary discourse helps to make sure that not only valuations are scrutinized but also contribute to making valuable business decisions.

Strategic Implications of Bridging Finance and Marketing

When marketing and financial thinking meet with ordering both brand valuation, the result is more than just accounting compliance or shopping-cart research-it is a tool of strategy. Companies obtain the capacity to make brand strategy and financial performance coincide which can inform investment, innovation and growth decisions.

An example is when venturing into new markets it can be used to know the best course of action, whether to use an established brand, acquire a local brand or a new identity, which has the best payoff. It also decides licensing and partnership discussions, whereby the power of the brand will directly affect the royalty charges, and the contractual agreement.

In addition, making the relationship between brand valuation, finance, and marketing clear reinforces the correlation within the organization. Marketers are able to show the fiscal payback of their activities, the finance team gets to appreciate beyond the purely dollar and cents. This promotes collaboration, eliminates a siloed bias, and makes brand-building efforts receive the investments they need.

In the highest conceptual levels, companies that are able to find a bridge between these two worlds establish their brands as tools of communication as well as drivers of shareholder-value. They are moving away from the short term metrics such as campaign reach to long-term targets such as sustainable profits and enterprise development.

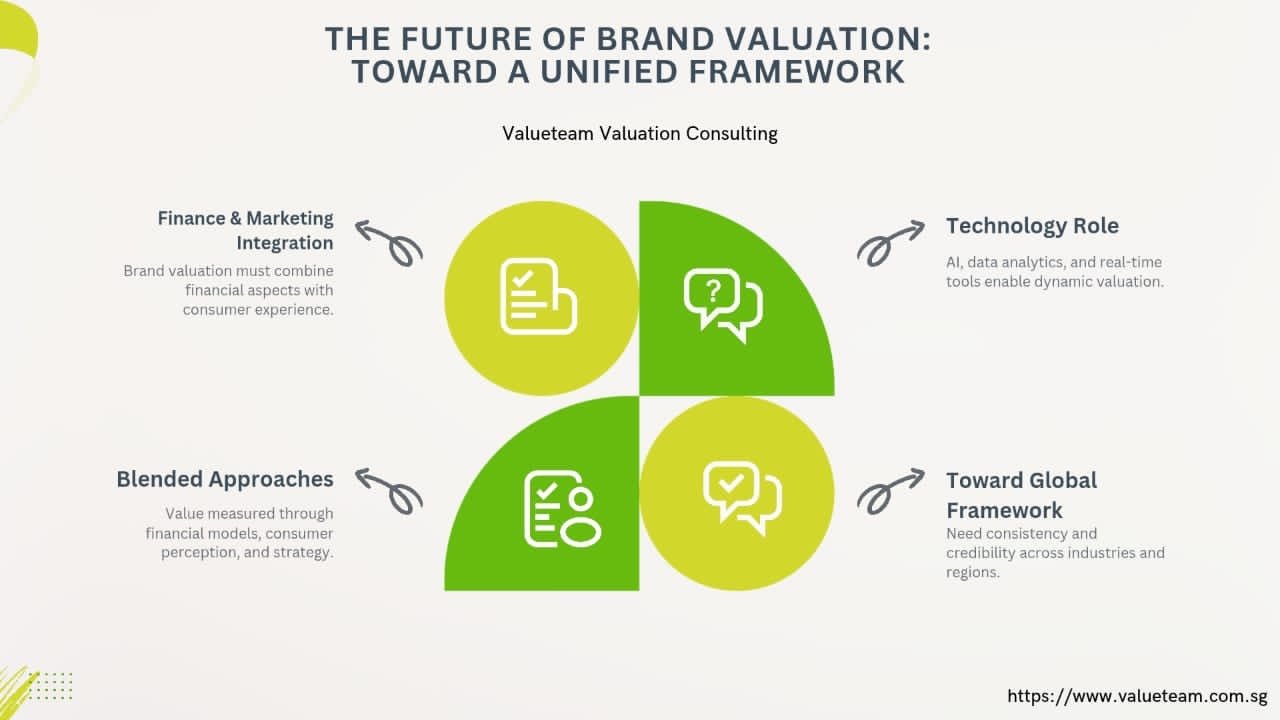

The Future of Brand Valuation: Toward a Unified Framework

As the environment in which the global economy operates continues to become increasingly dependent on intangibles, the financial and marketing aspects of brand valuation will further become important to integrate. Investors, regulators, and stakeholders are insisting that there be more transparency in terms of how brands are valued, meanwhile, consumers are continuing to reward businesses that provide authentic, meaningful experience.

The incoming trend is the convergence of brand value that is measured through a combination of brand valuation as performed by the financial models, brand as perceived by consumers and as constructed by the strategy providers. The maturation of data analytics, artificial intelligence, and real-time market measurements are further allowing brands to measure the complete performance spectrum of brands. These instruments provide the ability to get dynamic valuation that changes with market conditions, consumer mood and financial performance.

The next step that is put on the agenda is the consistency, comparability and credibility of valuation practices across industries and regions. The challenge is that standards organizations and professional bodies are still working on harmonizing methodologies but the important part is that businesses need to embrace the dual lens of finance and marketing as a lens that works together rather than one that competes against another.

Conclusion: The Bridge That Unlocks Brand Potential

Brand valuation is one of the potent integrators between finance and marketing. Companies ought to combine measurable financial results with the unquantifiable consumer-level insight in order to obtain a complete picture of the real values of their brands. Both increasing accountability and transparency and enabling businesses to align strategy, investment, and execution around their most valuable intangible assets, this synthesis boosts accountability and transparency.

As the business environment becomes increasingly competitive and intangible assets take center of corporate value, the capacity to bring the two worlds closer will be characteristic of the market leaders. Businesses that truly understand brand valuation as both a financial and marketing acquisition will not only realise the real worth of their brands but also the gateway to sustainable growth and long-term success.future of brand valuation