Accounting Intangibles under IFRS Standards

Accounting Treatment for Intangible Assets: Knowledge on Intangible Assets Under IFRS

Introduction to Accounting Intangibles under IFRS Standards

In the modern business landscape, intangible assets have become critical determinants of enterprise value. Brands, patents, customer relationships, and proprietary technologies now represent substantial components of corporate worth, often surpassing tangible assets in significance. Yet, the accounting treatment of these assets remains one of the most intricate areas of financial reporting. Understanding how to account for intangibles under the International Financial Reporting Standards (IFRS) is essential for organizations aiming to maintain transparency, comparability, and compliance.

This article explores the key principles governing intangible asset accounting IFRS, highlights practical applications, and examines how brand accounting methods Singapore have evolved to align with global standards. The focus is on deepening knowledge of IFRS principles to help finance professionals, auditors, and business leaders manage intangible assets with precision and integrity.

1. Defining Intangible Assets Under IFRS

1.1 Characteristics of Intangible Assets

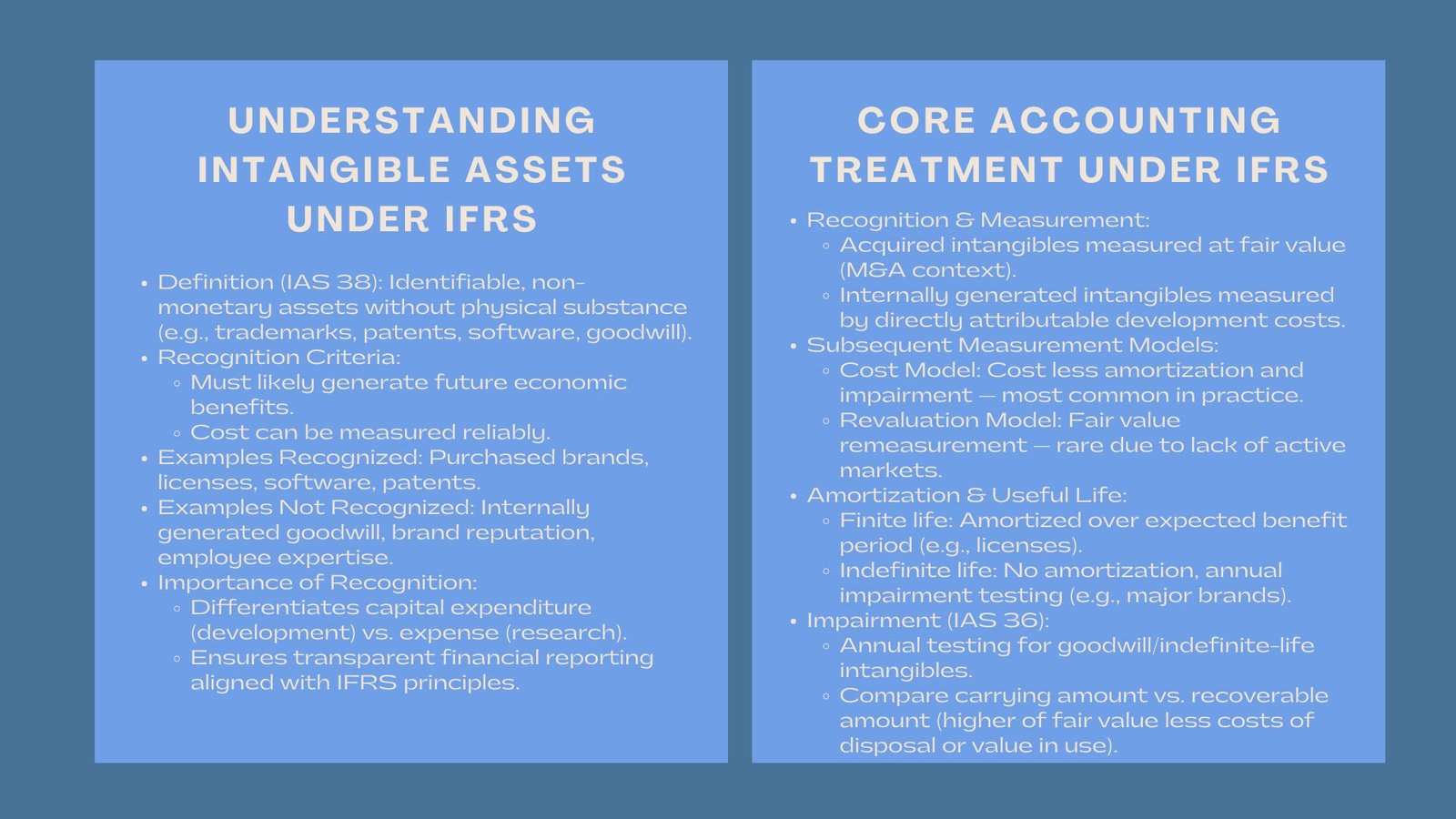

According to IAS 38 Intangible Assets, an intangible asset is identifiable, non-monetary, and lacks physical substance. It must also meet two critical criteria: the probability of generating future economic benefits and the ability to measure cost reliably. Common examples include trademarks, licenses, copyrights, software, customer contracts, and goodwill.

However, not all valuable resources qualify as intangible assets under IFRS. Employee expertise, brand reputation built internally, or customer loyalty—while crucial to business success—cannot be recognized on the balance sheet if they are internally generated. This distinction between identifiable and non-identifiable intangibles often causes confusion among companies transitioning to IFRS-based reporting.

1.2 Importance of Recognition

Recognition under IFRS determines whether an asset can be recorded in financial statements. The emphasis lies in differentiating between expenditures that create future value and those representing ongoing operational costs. For instance, costs associated with research activities are typically expensed, while development costs may be capitalized if they meet strict criteria.

2. Core Principles of Intangible Asset Accounting IFRS

2.1 Recognition Criteria and Challenges

Under IAS 38, an intangible asset is recognized only if it is:

- Identifiable – separable from the business or arising from contractual or legal rights.

- Controlled by the entity – the company must have power to obtain future economic benefits from the asset.

- Expected to bring future benefits – either through revenue generation or cost reduction.

In practice, applying these criteria can be complex. For example, determining whether software developed in-house qualifies for capitalization requires careful assessment of project feasibility, completion certainty, and potential commercial benefit.

2.2 Measurement at Initial Recognition

Initially, intangible assets are measured at cost. For acquired intangibles (such as in mergers and acquisitions), this cost equates to fair value at the acquisition date. Internally generated assets, on the other hand, are measured based on directly attributable costs—such as employee compensation, testing, and materials—incurred during the development phase.

3. Subsequent Measurement Models

3.1 Cost Model

Under the cost model, intangible assets are carried at cost less accumulated amortization and impairment losses. This method provides simplicity and consistency, making it the most common approach in practice.

3.2 Revaluation Model

Alternatively, the revaluation model allows assets to be carried at fair value, provided there is an active market for the asset. However, active markets for unique intangibles, such as brands or patents, rarely exist, limiting the model’s application.

In Singapore, regulators under the brand accounting methods Singapore framework typically recommend the cost model to ensure prudence and auditability, given the limited market data for intangible valuations.

4. Amortization and Useful Life Assessment

4.1 Finite vs. Indefinite Life

IFRS distinguishes between intangible assets with finite and indefinite useful lives. Finite-life assets (e.g., licenses or software) are amortized over their estimated useful lives, reflecting the pattern in which future economic benefits are consumed. Indefinite-life assets (such as certain brands) are not amortized but must undergo annual impairment testing.

4.2 Practical Challenges in Estimating Useful Life

Determining an asset’s useful life involves professional judgment and market analysis. Factors include legal protection, market dynamics, and technological evolution. For instance, software may have a shorter useful life due to rapid innovation, whereas a well-established brand might sustain value over decades. Misjudging these factors can lead to material misstatements in financial reports.

5. Impairment Testing and Fair Value Measurement

5.1 The Need for Regular Testing

IAS 36 Impairment of Assets requires entities to assess at each reporting date whether an intangible asset may be impaired. For indefinite-life assets and goodwill, this test must be performed annually, even in the absence of impairment indicators.

5.2 Calculating Recoverable Amounts

Impairment occurs when the carrying amount of an asset exceeds its recoverable amount—the higher of fair value less costs of disposal and value in use. Calculating these values involves forecasting cash flows and applying appropriate discount rates, which requires significant estimation and expert judgment.

In Singapore’s context, where corporate governance and audit scrutiny are high, companies must maintain robust documentation of assumptions used in impairment testing to meet brand accounting methods Singapore expectations.

6. Accounting for Acquired Intangible Assets in Business Combinations

6.1 Application of IFRS 3 (Business Combinations)

Under IFRS 3, acquirers must recognize identifiable intangible assets separately from goodwill during purchase price allocation (PPA). Brands, customer lists, and proprietary technologies are valued at fair value as of the acquisition date.

This process ensures transparency by distinguishing between purchased goodwill and identifiable assets. However, it introduces complexity when assigning fair values to intangible assets that lack observable market prices.

6.2 The Role of Valuation Experts

Independent valuation specialists often assist in quantifying these assets using income or market-based approaches. For example, the relief-from-royalty method estimates brand value based on hypothetical royalty savings if the company were to license the brand externally. Proper documentation of assumptions is vital for audit validation and IFRS compliance.

7. Disclosure Requirements Under IFRS

7.1 Transparency in Financial Statements

IFRS mandates detailed disclosures, including:

- The useful lives or amortization rates of intangible assets.

- The amortization methods used.

- Gross carrying amounts and accumulated amortization.

- Reconciliation of beginning and ending balances.

These disclosures enhance comparability across entities and help investors evaluate management’s valuation assumptions.

7.2 Integration with Sustainability and ESG Reporting

Emerging trends in Singapore indicate that brand-related disclosures increasingly intersect with ESG reporting. Investors now expect companies to demonstrate how their intangible assets—especially brands—support long-term sustainability and ethical governance. Integrating these narratives within financial disclosures enhances credibility and aligns with modern corporate transparency standards.

8. Practical Challenges in Applying IFRS Knowledge

8.1 Inconsistent Interpretation of Standards

Even with extensive guidance, IFRS interpretation varies across industries and jurisdictions. Determining whether an expenditure meets capitalization criteria often requires professional judgment, which can lead to inconsistencies in reporting.

8.2 Data and System Limitations

Many organizations still rely on outdated systems that fail to track intangible asset performance effectively. Without integrated ERP and valuation tools, companies struggle to update amortization schedules, impairment assessments, and fair value analyses in real time.

8.3 Balancing Prudence and Relevance

While IFRS promotes faithful representation, overly conservative accounting may understate brand strength, while aggressive valuation can mislead investors. Striking the right balance requires deep understanding of both market behavior and accounting principles.

9. The Singapore Perspective: Local Adaptation of Global Standards

Singapore’s Accounting Standards Council (ASC) fully aligns its Financial Reporting Standards (SFRS) with IFRS, ensuring consistency in recognition and measurement. However, regulators emphasize additional audit rigor and disclosure clarity, especially for brand and goodwill valuations.

Many Singaporean firms apply hybrid models that combine IFRS-compliant valuation with localized sensitivity analyses to reflect market volatility in Southeast Asia. The brand accounting methods Singapore framework encourages conservatism and transparency, emphasizing documentation and cross-functional collaboration between finance and marketing teams.

10. Conclusion: Elevating Knowledge for Strategic Compliance

Mastering the accounting treatment for intangible assets requires more than technical skill—it demands strategic insight and disciplined application of IFRS principles. By understanding recognition rules, measurement options, and disclosure obligations, organizations can ensure accuracy, transparency, and investor trust.

In the knowledge-driven economy, the ability to apply intangible asset accounting IFRS effectively is a cornerstone of financial integrity. As Singapore continues to align with international standards through its brand accounting methods Singapore, companies that cultivate deeper expertise in IFRS compliance will be best positioned to translate their intangible strength into sustainable, reportable value.