Accounting Challenges in Digital Brand Assets

Accounting Challenges in Digital Brand Assets

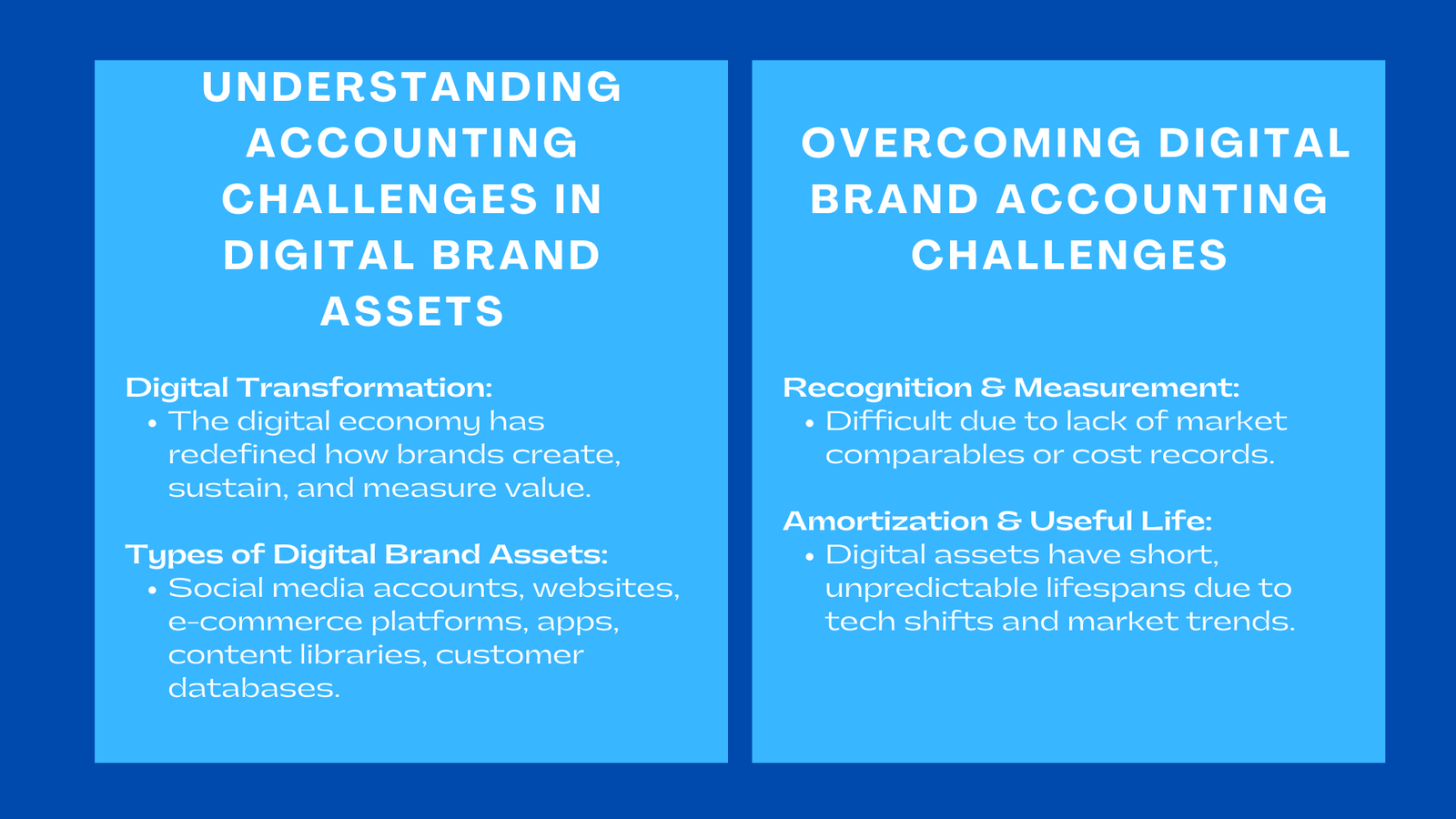

The digital economy has fundamentally transformed the way brands create, sustain, and measure value. Digital brand assets—including social media channels, proprietary mobile applications, corporate websites, e-commerce platforms, online content libraries, and digital customer databases—are no longer peripheral; they are central to customer engagement, loyalty, and revenue generation. Organizations that fail to recognize and manage these assets risk undervaluing key sources of competitive advantage and enterprise worth.

Despite their strategic significance, digital assets present unique digital brand accounting challenges. Unlike traditional brand elements such as trademarks, logos, or physical marketing collateral, digital assets are inherently dynamic, intangible, and often interdependent. Their value fluctuates rapidly based on user engagement, technological evolution, market competition, and regulatory developments. Consequently, recognizing, measuring, and reporting these assets under IFRS standards is complex but crucial for regulatory compliance, auditability, and strategic decision-making.

Accounting for digital brand assets requires organizations to address issues related to recognition, valuation, amortization, data reliability, and integration with overall brand valuation. The growing reliance on digital platforms and online customer touchpoints intensifies the need for systematic approaches to valuation and reporting. This article explores these accounting challenges in depth, discusses practical strategies to address them, and presents a Singapore-based case study illustrating real-world application of IFRS-aligned digital asset accounting.

The Rise of Digital Brand Assets

Types of Digital Assets

Digital brand assets encompass a wide array of elements that collectively shape a company’s identity, market reach, and revenue potential. These assets include social media accounts, domain names, corporate websites, e-commerce platforms, content libraries, mobile applications, proprietary software, and digital customer databases. Each of these contributes uniquely to brand visibility, customer interaction, and monetization opportunities. Similar to how best practice accounting firm valuation in Singapore emphasizes structured methods and compliance with financial standards, effective management of digital brand assets requires systematic valuation approaches to accurately reflect their impact on enterprise value.

Unlike traditional brand elements, digital assets are highly dynamic. A social media channel can gain thousands of followers in weeks or experience rapid decline, websites require continuous content updates to maintain relevance, and mobile apps may be disrupted by technological changes or competitive innovations. These characteristics complicate accounting, as assumptions about asset value can quickly become obsolete. Consequently, companies must establish valuation frameworks that can adapt to rapid technological and market shifts while remaining IFRS-compliant.

Strategic Importance of Digital Assets

Digital assets are no longer ancillary; they are core to brand strategy and enterprise value. A strong digital presence allows organizations to engage customers more effectively, build loyalty, influence pricing strategies, and achieve higher market share. For instance, an online retailer with a well-optimized website and a robust mobile app ecosystem may drive a significant portion of revenue through digital channels, directly impacting the brand’s financial contribution to the organization.

Similarly, social media engagement can influence customer acquisition, retention, and advocacy. Brands with highly interactive and trusted digital platforms often command greater market visibility and customer preference, translating into tangible revenue growth. Yet, despite their strategic importance, digital brand assets are often undervalued in financial statements due to accounting complexities, leaving companies vulnerable to underreporting or misrepresentation of their true enterprise value.

Key Accounting Challenges in Digital Brand Assets

Recognition and Measurement

IFRS standards stipulate that intangible assets must be identifiable, under the control of the entity, and expected to generate future economic benefits. Digital assets, however, often lack historical cost records or observable market comparables, making recognition difficult. Valuation frequently requires projecting revenue contributions, user engagement trends, or customer lifetime value—all inherently subjective metrics.

For example, valuing a proprietary mobile application may involve estimating future subscription revenue, advertising income, or digital content monetization. These projections rely on assumptions about user growth, retention rates, competitive dynamics, and platform evolution. Failure to properly recognize these assets can result in undervaluation, financial misrepresentation, and non-compliance with IFRS requirements, ultimately affecting investor perception and strategic decision-making. Clear documentation of assumptions, methodology, and rationale is essential to ensure both auditability and transparency.

Amortization and Useful Life

Determining the useful life of digital brand assets presents a particular challenge. Rapid technological obsolescence, platform volatility, cybersecurity threats, and changing consumer preferences can reduce the lifespan of digital assets dramatically.

A mobile application, for example, may become obsolete within two to three years due to software updates, operating system changes, or competitor innovation. Similarly, corporate websites may require periodic redesigns to remain relevant, and social media channels may decline in effectiveness due to algorithm changes or shifts in consumer behavior. As such, companies must conduct regular impairment testing and adjust amortization schedules to reflect realistic asset lifespans, ensuring that financial statements accurately reflect the current value of digital brand assets.

Data Reliability and Verification

Reliable and verifiable data is the foundation of accurate digital asset valuation. Key metrics include user engagement, conversion rates, traffic analytics, retention statistics, and customer acquisition costs. Establishing a robust data governance framework ensures that these metrics are accurate, auditable, and consistently reported across accounting periods.

Practically, this requires integrating marketing analytics, IT reporting systems, and financial projections to create a unified dataset. Cross-functional collaboration between finance, marketing, and IT teams ensures alignment of data collection methods, reporting standards, and validation processes. A lack of consistent data governance can lead to misstatements, regulatory non-compliance, and erosion of investor confidence.

Integration with Overall Brand Valuation

Digital assets must not be evaluated in isolation. Their contribution to enterprise value should be assessed in conjunction with other brand components, such as trademarks, reputation, and customer loyalty. Coordination between marketing, IT, and finance ensures that digital performance metrics—such as engagement, retention, and monetization—are accurately translated into financial projections and overall brand valuation.

For example, a mobile app may simultaneously drive customer loyalty, increase direct sales, and enhance brand perception. If these interdependencies are ignored, the company risks an incomplete valuation that misguides strategic investments or misallocates resources, potentially undermining growth opportunities.

Practical Approaches to Address Digital Brand Accounting Challenges

Developing Standardized Valuation Methodologies

Organizations should adopt standardized methodologies that combine multiple valuation approaches. The Income Approach evaluates revenue-based contributions, the Market Approach relies on comparable transactions, and the Cost Approach estimates replacement or development costs.

For instance, a streaming platform may calculate discounted future revenue from subscriptions and advertising attributable to its digital assets. Using multiple approaches allows cross-validation, improving reliability and compliance with IFRS standards. Standardized methodologies also create transparency for auditors, investors, and regulators, demonstrating that digital asset valuation is systematic and defensible.

Implementing Robust Data Governance

Reliable, auditable data is essential for credible digital asset valuation. Governance policies should ensure consistent tracking of engagement metrics, conversion rates, monetization, and other KPIs. Data sources, assumptions, and calculation methods must be fully documented to maintain transparency and meet audit requirements.

A strong data governance framework supports not only IFRS compliance but also strategic decision-making. It enables management to quantify the real contribution of digital assets to enterprise value, identify growth opportunities, and respond efficiently to regulatory inquiries or investor scrutiny.

Scenario Planning and Sensitivity Analysis

Scenario planning allows organizations to model the impact of technological disruption, market shifts, or regulatory changes on digital asset value. Sensitivity analysis quantifies how variations in assumptions—such as engagement trends, revenue projections, or customer acquisition costs—affect overall valuation outcomes.

For example, social media algorithm changes could significantly alter user engagement levels, directly impacting projected cash flows from digital marketing efforts. Modeling multiple scenarios enables management to anticipate potential risks, adjust strategies proactively, and ensure that valuation assumptions remain realistic under various market conditions.

Continuous Monitoring and Revaluation

Digital assets evolve rapidly, necessitating ongoing monitoring and periodic revaluation. Tracking changes in user engagement, monetization metrics, revenue contribution, and competitive positioning ensures that valuations remain accurate and relevant.

Revaluation allows organizations to adjust asset values promptly in response to emerging opportunities or threats. For instance, a sudden increase in app downloads or subscription revenue may justify an upward revision in asset value, whereas declining engagement might trigger impairment testing. Continuous monitoring enhances IFRS compliance, informs strategic planning, and supports investment decisions regarding digital platform development and marketing resource allocation.

Case Study: E-Commerce Brand in Singapore

A Singapore-based e-commerce platform faced significant challenges in valuing its digital brand assets for IFRS reporting. Its portfolio included a mobile application, corporate website, online marketplaces, and multiple active social media accounts. Recognizing the complexities of digital asset valuation, the company implemented a structured framework combining the Income Approach with Market Approach comparables.

Robust data governance protocols ensured accurate tracking of engagement metrics, conversion rates, and revenue attribution. Scenario planning and sensitivity analysis allowed management to model impacts of regulatory changes, shifts in social media algorithms, and competitive dynamics on projected revenues. Continuous monitoring ensured valuations reflected current market realities, supporting timely strategic decisions regarding marketing spend, content development, and platform enhancements.

This comprehensive approach enabled the company to accurately quantify the financial contribution of digital assets to overall enterprise value. IFRS-compliant valuation enhanced transparency, strengthened investor confidence, and improved operational decision-making. The framework also provided actionable insights, enabling management to prioritize high-impact digital initiatives, optimize marketing investments, and strengthen competitive positioning in a rapidly evolving e-commerce landscape.

Conclusion to Accounting Challenges in Digital Brand Assets

Accounting for digital brand valuation IFRS digital assets presents complex challenges due to recognition, measurement, amortization, and data verification issues. Digital assets are inherently dynamic, often lacking historical cost records, and require careful integration with overall brand valuation frameworks to accurately reflect their contribution to enterprise value.

Organizations that adopt standardized valuation methodologies, robust data governance practices, scenario planning, sensitivity analysis, and continuous revaluation can ensure that digital brand assets are accurately quantified, compliant with IFRS standards, and strategically leveraged.

Accurate digital asset valuation enhances transparency, strengthens investor confidence, informs strategic decision-making, and ultimately contributes to long-term enterprise value. In today’s highly competitive digital economy, companies that effectively account for and manage digital brand assets gain a significant advantage, ensuring that these intangible assets deliver sustainable financial, operational, and strategic benefits.