Trends in Online Brand Valuation

Trends in Online Brand Valuation

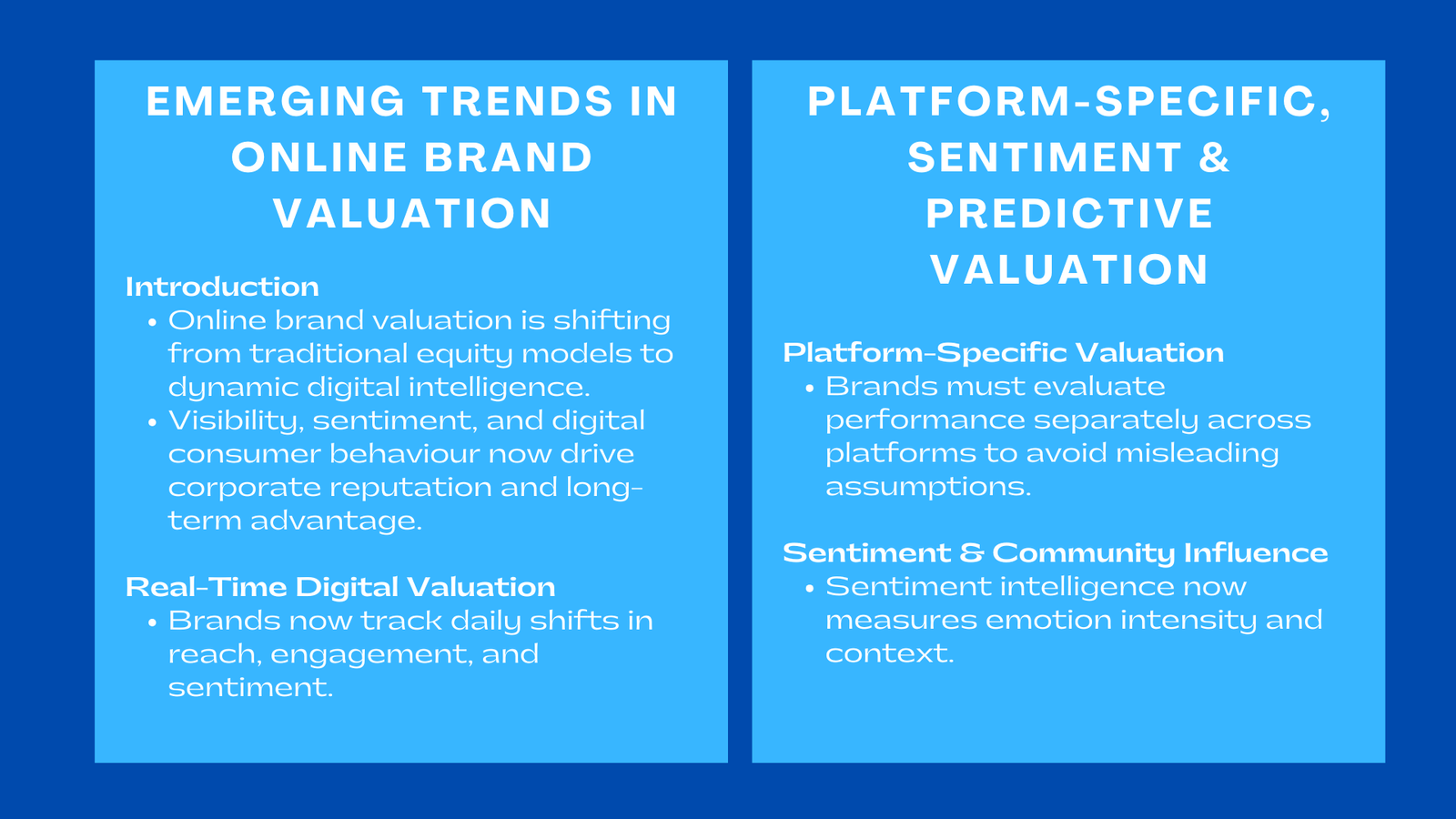

Introduction to Trends in Online Brand Valuation

Online brand valuation has become a complex science based on the accelerating online interaction, analytics of data and platform-based behavioural intelligence. Because the old models of valuation are unable to recognize the dynamism of online transactions, organisations are more and more depending on the high level of digital intelligence to gauge brand strength on demand. The change in the old-fashioned equity valuation to dynamic digital valuation is a symptom of the overall revolution of brand management, in which visibility, sentiment, and consumer behaviour on digital platforms determine the corporate reputation and the long-term competitive advantage. This paper discusses the impact of the emerging level of digital intelligence in determining online brand value and the future implication on organisations that want to remain strategic in the digital world which is swiftly evolving, especially for those seeking brand valuation Singapore expert services to strengthen their competitive positioning.

1. The Real-Time Digital Valuation Emergence.

1.1 The Digital Performance Monitoring Acceleration.

Digital worlds are running at an extremely fast pace, thus compelling organisations to implement real-time assessment systems to monitor brand dynamics. Companies are even monitoring fluctuations in reach, engagement and sentiment on a daily basis, rather than just using quarterly or annual indicators of their performance. These live experiences generate a more precise and more dynamic system of valuation that allows brands to recognize the opportunities and threats that are arising in advance of them having material impacts. The increasing use of these immediate response structures is a response to the dynamic characteristics of digital ecosystems where perception and engagement change in hours depending on social trends, influencer activity, or changes in an algorithm used by a platform.

1.2 Dashboards as a Strategic Decision Structure.

Modern valuation dash boards are able to merge data streams into logical analytical systems that drive strategy. Organisations combine the analytics of websites, the results of the social listening process, ranking in the marketplace, and the performance of digital advertising in general as a set of tools of brand intelligence. These dashboards allow executives to observe how Online brand value trends evolve across multiple platforms and customer segments, strengthening the organisation’s ability to shape performance intentionally. The trend towards readily interpretable real-time information increases internal alignment and enhances the quality of brand-based strategic decision-making.

2. Value Multiplier Behavioural Analytics.

2.1 Consumer Intent and Micro-Behaviours.

The measurement of the online brand value is increasingly relying on the behavioural analytics which gauge the interaction of the consumer with the digital properties. Micro-behaviours: Hover time, click depth, scroll velocity and interactive gestures demonstrate minor patterns in the intensity of engagement and customer preference. These granular indicators assist organisations to know which brands are relevant in the fast evolving competitive online markets. Behavioural indicators also provide objective information that supplements sentiment based appraisals leading to more elaborate and predictive valuation models.

2.2 Predictive Value: Behavioural Insights to Predictive Value.

Machine learning algorithms can be used to convert behavioural patterns into predictive information based on the correlation of digital behaviour and future commercial results. These models recognise behavioural signatures associated with customer loyalty, probability of conversion or risk of churn. Predictive analytics applied to valuation methodologies can help organisations determine the value of a brand with more precision when included in them. This paradigm shift indicates that behavioural modelling cannot be ignored in the digital valuation arena, which helps in making smarter investment choices and more focused strategic responses.

3. Differences between platform-specific valuations.

3.1 Diversity in Digital spaces.

The behavioural norms, algorithmic forms and users of digital platforms are distinct and demand platform specific valuation. Brand A can be very engaged on the short-form video platforms and moderately performing on the image or text-based channels. This inconsistency requires streams of evaluation to prevent false premises concerning brand health. The platform-specific valuation will make the diagnostics more clear and contribute to the more sophisticated perception of digital brand equity.

3.2 Effect of algorithmic and brand visibility.

In almost all the large digital platforms, algorithms decide how content is distributed, whether it receives a high relevance score, and whether it is visible or not. Consequently, the online brand valuation will have to integrate algorithm-aware knowledge, i.e. how ranking variables impact the brand exposure. Such brands that maximise content to meet the priorities of the algorithms have better valuation results. Due to the escalating complexity of the algorithmic intelligence, it is important that organisations become strategically agile in order to ensure that content formats and engagement strategies are developed so that organisations remain visible to their competitors.

4. Reputation Indicator Sentiment Intelligence.

4.1 Emotional Insights in Digital Evaluation

The digital evaluation is also known to be highly affected by emotions. The sentiment intelligence tools have also developed past the mere positive and negative analysis, but they are measuring emotion type, intensity, and contextual relevance. These in-depth insights enable organisations to know how various segments will react to brand communication in terms of emotions. Through understanding the particular triggers that shape the perception of people, businesses will be able to streamline communications that strengthen positive attitude. Such emotional insights are leading indicators of digital valuation models.

4.2 Community-Driven Influence

In shaping digital brand narratives, online communities both formal and informal are very important. All these platforms, including Reddit, Tik Tok communities, niche forums, etc, increase brand discussion and shape public opinion. The sophisticated digital valuation frameworks assess these community dialogues, projecting their impact on the general change of reputation. It is now becoming important to understand community-driven sentiment to forecast brand resilience in unstable digital context.

5. Predictive Intelligence on the Modelling of Valuation.

5.1 The Perspective of the Long-term Brand Trajectories.

Predictive intelligence frameworks combine historical trends, behavioural information and platform-specific trends to predict brand equity trends. The models assist organisations to predict the market responses, detect the initial red flags, and make brand-building investment choices much more precisely. Predictive intelligence will make sure that valuation is more than the description of the current conditions but a projection of future brand outcomes.

5.2 Strategy Correspondence to Digital Roadmaps.

Prophetic estimation offers strategic realignment of brand equity objectives and operation strategies as businesses create long-term digital transformation programs. By integrating these insights, companies can design long-term investment portfolios that can help them to maintain long-term digital competitiveness. The intersection of predictive modelling and Digital brand strategy 2025 marks a significant evolution in how organisations approach valuation, ensuring that strategic clarity is maintained across extended planning horizons.

6. First-Party Data as a Strategic Valuation Asset

6.1 The Rising Importance of Proprietary Data

As the regulatory constraints imposed on data used by third-party individuals continue to rise, first-party data has become an important asset in online brand valuation. It offers unparalleled understanding of customer behaviour and it enables organisations to tailor experiences to a greater degree. The power and exclusive utilization of this data will directly affect the brand value due to the contribution to more precise segmentation, retention analysis, and predictive modelling.

6.2 Equities as an Equity Driver.

First-party data can be used to support advanced personalisation strategies, which increase customer satisfaction and lifetime value. The more relevant and timely the contact of the customer, the higher their loyalty and the digital brand equity. Such customised interactions provide a framework of valuation power over the long term.

Conclusion

A radical transformation that online brand valuation is encountering is due to sophisticated digital intelligence, behavioural modeling, sentiment analytics, and predictive projections. Organisations aiming to leverage platform-specific assessment systems, create powerful data platforms and incorporate real-time insights in strategising will remain a stronger brand and a strong competitive position in the digital markets. With the further development of digital ecosystems, online valuation will be based more on the integrated intelligence platforms that reflect all the complexity of consumer behaviour and platform dynamics. The firms that adopt these new methodologies will gain better strategic sense, more precise decision-making and long term brand equity in a fast-changing competitive environment.