Brand Valuation Compliance Checklist for Companies

Brand Valuation Compliance Checklist for Companies

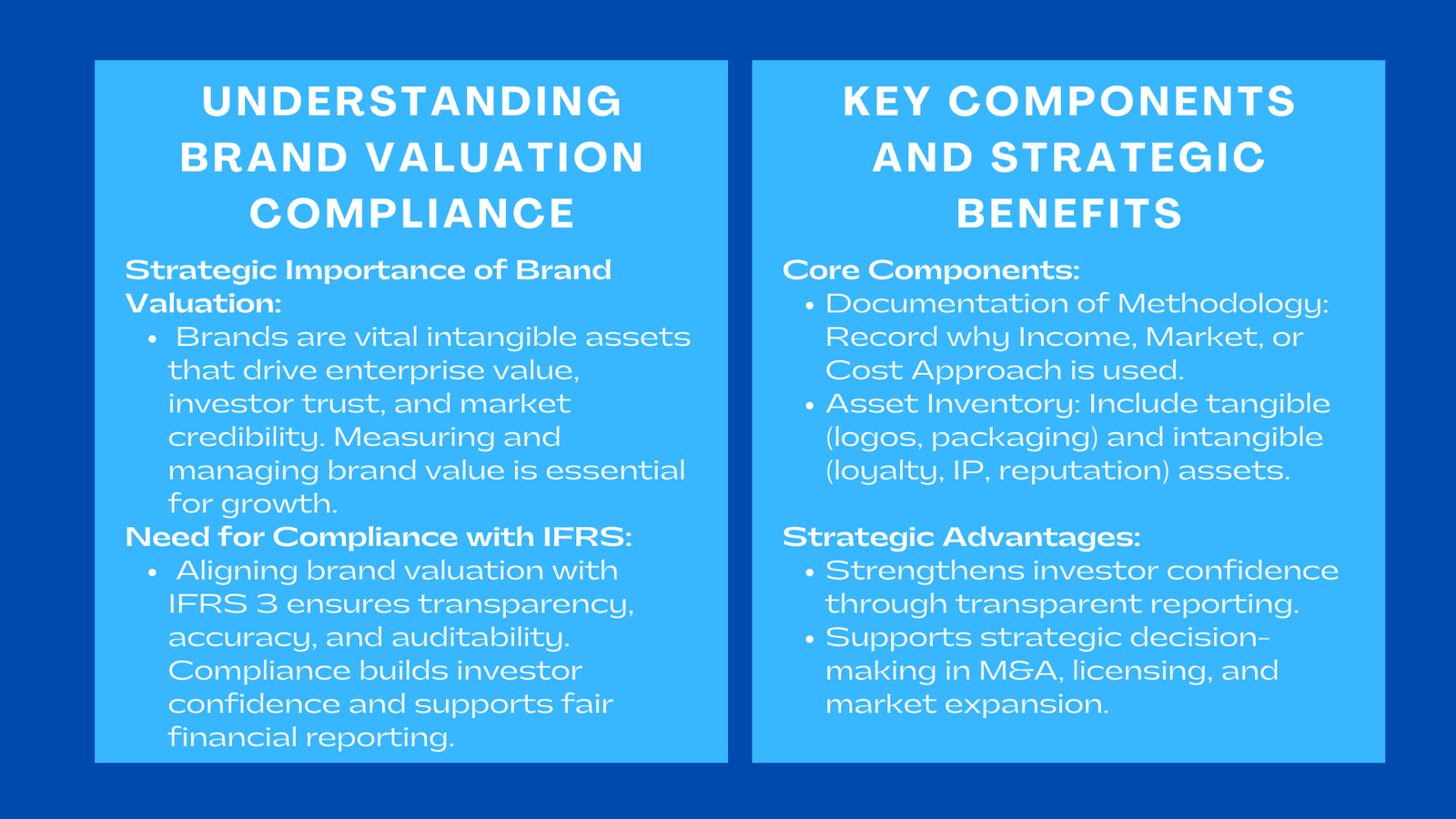

Brand valuation has become a cornerstone of modern corporate strategy. Beyond marketing, brands are now recognized as critical intangible assets that substantially contribute to enterprise value. In today’s competitive business environment, a company’s brand often accounts for a significant portion of its market capitalization. This reflects not only customer recognition or loyalty but also the financial potential embedded in brand equity, including reputation, intellectual property, and customer relationships. Companies that neglect to measure and manage brand value risk losing both market credibility and long-term growth opportunities.

In an increasingly regulated global environment, compliance with accounting standards—particularly the International Financial Reporting Standards (IFRS)—is essential. Accurate brand valuation ensures transparency, auditability, and strategic utility. Organizations must demonstrate that their valuation process aligns with established accounting principles to satisfy investors, auditors, regulators, and other stakeholders. Compliance is no longer a back-office function; it is a strategic requirement that affects corporate reputation, investment attractiveness, and capital allocation decisions.

A structured brand compliance reporting checklist provides a practical framework for companies to review processes, document assumptions, and ensure alignment with IFRS guidance. It functions both as a regulatory tool and a strategic instrument, guiding decisions in mergers and acquisitions, capital raising, licensing, and performance management. This article explores the essential components of such a checklist, highlights practical implementation strategies, and examines the strategic advantages of compliance in building sustainable brand value for modern organizations.

Understanding IFRS Requirements for Brand Valuation

IFRS 3 and Brand Recognition

IFRS 3, governing business combinations, requires companies to recognize identifiable intangible assets, including brands, at fair value during acquisitions. Brands must be evaluated either through observable market transactions or through the discounted present value of projected cash flows generated by the brand. This approach is also relevant when assessing the key components of brand valuation in Singapore businesses, ensuring that the financial statements accurately reflect the economic reality of the acquired entity, providing stakeholders with reliable and transparent information.

For example, during the acquisition of a consumer goods company, brand recognition and loyalty can constitute a substantial portion of the purchase price allocation (PPA). Ignoring these intangibles may lead to understated asset value, misrepresentation of enterprise value, and ultimately, a misalignment between the reported financials and the organization’s strategic positioning. Proper recognition of brands in compliance with IFRS 3 safeguards the balance sheet, maintains investor confidence, and supports robust decision-making regarding mergers, acquisitions, and resource allocation.

IFRS Guidance on Measurement and Reporting

IFRS standards provide explicit guidance on measuring intangible assets, emphasizing the need to document assumptions such as expected economic benefits, useful life, amortization schedules, and impairment indicators. Companies must ensure that these valuations are auditable, reliable, and defensible during regulatory inspections or investor reviews.

For multinational corporations, adherence to IFRS also ensures consistency and comparability across jurisdictions, enabling stakeholders to assess performance and make informed investment decisions. Standardized reporting across markets enhances credibility, reduces regulatory risk, and reinforces the strategic alignment between brand management and enterprise growth objectives.

Key Components of a Brand Compliance Reporting Checklist

Documentation of Valuation Methodology

A central aspect of brand compliance is the comprehensive documentation of the chosen valuation methodology. Companies must explain why a particular approach—Income, Market, or Cost—was selected and provide detailed justification for assumptions, including projected growth rates, discount rates, market multiples, and anticipated cash flows over the asset’s useful life.

For instance, a luxury fashion brand may primarily rely on the Income Approach to project revenue streams from brand loyalty and premium pricing, cross-referencing with Market Approach multiples to validate results. Proper documentation ensures that auditors, regulators, and stakeholders can trace the rationale and assumptions underlying the valuation. Additionally, robust documentation mitigates the risk of disputes, regulatory challenges, and errors, particularly when valuations influence strategic decisions such as licensing, M&A activity, or brand portfolio optimization.

Asset Identification and Inventory

Organizations must maintain a comprehensive inventory of all brand-related assets. This includes tangible components such as logos, packaging, promotional materials, and digital assets, as well as intangible elements such as customer loyalty, market reputation, proprietary methodologies, and digital presence. Accurate inventorying ensures that all contributors to brand value are accounted for and measured consistently, providing a solid foundation for valuation and reporting.

Beyond compliance, an organized asset inventory provides strategic insights. It allows management to identify which brand components drive the most value and where additional investment is required. For example, a company may discover that its mobile applications and e-commerce channels contribute disproportionately to projected revenues, informing both marketing priorities and capital allocation. Maintaining a structured inventory is therefore as much a strategic tool as it is a compliance necessity.

Data Collection and Validation

Reliable brand valuation depends on robust data collection and validation processes. Companies must systematically gather financial metrics, market research insights, competitive intelligence, and customer perception surveys. Validation ensures that assumptions are grounded in verifiable and credible information, minimizing the risk of misstatement or bias.

Cross-functional collaboration is critical in this context. Finance teams contribute detailed revenue projections and cost structures, marketing provides insights on customer engagement and brand perception trends, and operations ensures accurate inclusion of production, distribution, and service-related inputs. By integrating these data streams, companies can generate a holistic and accurate view of brand value that withstands both regulatory and investor scrutiny.

Sensitivity Analysis and Scenario Planning

Conducting sensitivity analysis helps companies understand how variations in key assumptions, such as discount rates, projected growth, or market conditions, affect brand valuation. Scenario planning further enhances strategic foresight by modeling potential operational or market disruptions to evaluate their impact on brand value.

For instance, a multinational hospitality company may assess how fluctuating travel patterns, economic downturns, or competitive actions could influence projected revenue streams linked to its brand. By simulating various scenarios, management can proactively develop contingency plans, adjust strategic initiatives, and maintain resilience in volatile environments. These analyses serve dual purposes: they satisfy regulatory expectations and provide actionable insights for strategic management.

Reporting and Audit Readiness

A compliance checklist must detail procedures for reporting brand valuation results and ensuring audit readiness. Reports should transparently explain methodology, assumptions, sensitivity analyses, and final valuation figures. Audit-ready documentation not only enhances transparency but also demonstrates that the organization’s brand valuation processes are systematic, repeatable, and defensible.

Integration of valuation reporting with broader financial statements is essential. By ensuring that brand valuations meaningfully contribute to enterprise value assessments, companies provide stakeholders with clear insights into the financial significance of intangible assets. Organizations that maintain audit-ready documentation are well-positioned to respond efficiently to regulatory inquiries, investor questions, and market scrutiny, enhancing credibility and operational resilience.

Strategic Benefits of Brand Compliance

Strengthening Investor Confidence

Adherence to a structured compliance checklist enhances transparency in financial reporting, bolstering investor trust and reinforcing corporate credibility. Companies that demonstrate IFRS-compliant brand valuation are more likely to attract investment, secure strategic partnerships, and optimize outcomes in mergers and acquisitions.

Publicly listed companies benefit particularly from compliance, as IFRS-aligned reporting signals to the market that the organization values accurate intangible asset management. This can influence investor perceptions positively, potentially resulting in higher share price stability, lower cost of capital, and more robust capital raising opportunities.

Supporting Strategic Decision-Making

Accurate brand valuations provide actionable insights for strategic initiatives. These insights inform decisions regarding licensing agreements, marketing budgets, product launches, market expansion, and merger or acquisition strategies. For example, a global cosmetics company evaluating entry into a new geographic market can use brand valuation insights to decide whether investing in local digital campaigns, partnerships, or product localization offers the highest return on investment. Quantifying the financial contribution of brand assets enables management to prioritize initiatives that maximize growth and enhance long-term enterprise value.

Risk Management and Regulatory Preparedness

A structured brand compliance checklist mitigates risks related to regulatory scrutiny, reporting errors, and reputational damage. By documenting assumptions, methodologies, and data sources in a transparent manner, companies can respond promptly and accurately to audits, regulators, and investor inquiries.

Proactive compliance also enhances operational resilience. Organizations that anticipate regulatory requirements are less likely to face penalties or reputational harm, and they can differentiate themselves in competitive markets by demonstrating governance excellence, transparency, and strategic foresight.

Case Study: Singapore-Based FMCG Brand

A Singapore-based fast-moving consumer goods (FMCG) company preparing for acquisition provides a practical example of the value of a brand compliance checklist. The company implemented a structured framework, meticulously documenting valuation assumptions, capturing both tangible and intangible assets, and ensuring alignment with IFRS 3 guidance.

Through sensitivity analysis and scenario planning, management identified which brand lines were most resilient and valuable in fluctuating market conditions. Digital marketing channels, loyalty programs, and social media engagement emerged as critical drivers of projected revenue streams. These insights informed negotiation strategies, purchase price allocation decisions, and post-acquisition integration planning.

This case demonstrates that brand compliance checklists offer more than regulatory assurance—they provide strategic clarity. Organizations that follow such frameworks gain a comprehensive understanding of brand value, mitigate financial risk, and strengthen both operational and strategic positioning.

Conclusion to Brand Valuation Compliance Checklist for Companies

A brand compliance reporting checklist aligned with IFRS brand valuation guidance is essential for modern companies. Comprehensive documentation of methodology, detailed asset inventories, rigorous data collection, sensitivity analyses, and audit-ready reporting are fundamental to ensuring accurate, defensible, and actionable brand valuations.

Adopting a structured compliance framework strengthens financial reporting, enhances investor confidence, and provides actionable insights for strategic decision-making. Over time, compliance-oriented brand valuation frameworks support sustainable enterprise growth, maximize intangible asset value, and provide a competitive advantage in dynamic global markets. Companies that embrace these practices not only satisfy regulatory requirements but also leverage brand valuation as a strategic tool, driving long-term success and resilience in an increasingly complex business environment.